Freight brokers are liaisons or middlemen that connect shippers with carriers to transport goods while helping both parties reduce cost and maximize efficiency. However, they mostly serve as transportation intermediaries, meaning they don’t operate a fleet directly.

Instead, they rely on carriers to move freight to their destination while they facilitate, coordinate, and manage the supply chain process. As a result, one question that keeps resurfacing in the growing freight industry is whether a freight broker can own commercial trucks.

Yes, freight brokerage and a trucking fleet can be combined into an all-inclusive solution. Many established or new brokers integrate vertically by procuring a dedicated fleet of new or used freight vehicles via cash, leasing, or a lease-to-own agreement.

This allows them to take full control of the freight supply chain and increase their income streams instead of merely working for a commission. However, there’s plenty to consider when opting for this route.

In this post, we’ll share the advantages of freight brokers operating a fleet of trucks, highlight important considerations and provide an informative case study to highlight some of the main concepts in this guide.

Advantages of Owning a Fleet

Owning a fleet as a freight broker gives you an upper hand in negotiating deals with shippers and managing carrier operations in-house. The following are some of the most lucrative advantages of this prospect.

Better Control of Schedule Planning

One of the biggest challenges brokers face is controlling their schedules. Since most carriers are looking to maximize revenue, they usually prioritize higher profit deliveries during backlogs.

While this may satisfy the needs of some shippers, it will most likely increase transit and delivery times for others, leading to delays and higher dissatisfaction. The situation worsens when carriers wait for backhauls to avoid layovers and dead miles (coming back with no cargo).

As a freight broker, you want maximum control over schedule planning, and this is only possible by owning a dedicated fleet. By procuring freight vehicles to enable carrier operations in-house, you can increase your overall quality of service by prioritizing shippers’ deliveries and preventing delayed communication or miscommunication.

Moreover, since you’ll no longer be entirely reliant on third-party carriers, you can take bold decisions, such as minimizing or even eliminating dead miles and prioritizing client satisfaction over one-time profit.

Higher Profit Margins

Freight brokers make money by charging an intermediary fee for their services (around 5-10% of the net margin on each load). This is the amount they charge shippers minus the amount they pay outsourced carriers.

By operating a dedicated fleet, brokers no longer have to pay outsourced carriers. Instead, they get 100% of the shipment payment along with all the profits associated with the shipment. Of course, the profit margin will depend on how much more they charge shippers on top of their expenses.

In any case, profits are much higher than the profits gained from offering just freight brokerage services. By combining both business units, brokers can enable cross-functional collaboration and reduce their overall expenditure while stacking the profits from both functions.

Profit margins can also be increased in other ways by owning a dedicated fleet. For instance, brokers can choose to stick with the most profitable routes and shipment types.

They can also improve their vehicles with advanced routing software and better tires to save fuel and time. Furthermore, with full control of carrier operations, brokers can negotiate directly with shippers, especially when they have empty trucks.

Ability to Offer a More Complete Solution

Owning a dedicated fleet enables freight brokers to have more logistical control over freight transport in terms of time and location.

More importantly, it transforms them into a more complete solution provider for freight transport. However, it’s important to note that this depends on the type and quantity of freight vehicles they own.

Even if they don’t have a big enough fleet to handle 100% of their operations, they can still outsource some of their shipments to other carriers. Many established brokers use this strategy to diversify their value offerings.

For instance, some partner with other carriers to integrate more transport modes (air, sea, or rail) to expand their routes or handle special cargo (refrigerated, fragile, out of gauge, and others).

Meanwhile, others integrate intermodal, drayage, and drop-trailer services into their operations, among various other services.

To summarize, owning and running a dedicated fleet of freight vehicles gives freight brokers more freedom and flexibility to invest in different technologies, explore new industry sectors, and optimize their value chain according to their business direction.

Stronger Credit Control

Most shippers pay for the services rendered after their shipment reaches its final destination. Shippers with larger volume often enjoy credit terms with their brokers (Net 30 days for example).

Conversely, carriers typically ask for payment upfront or work with reduced payment terms (especially with smaller freight brokers). As a result, they usually have to outlay a significant sum before they receive payments from shippers.

This limits the broker’s working capital and puts their operations at greater risk. However, by owning a dedicated fleet, freight brokers can put their profit margins on hold while waiting for their payments.

In turn, they don’t have to disrupt their workflow and can ensure they always have enough cash on hand (increased cash flow) to cover operating expenses and other types of costs.

Moreover, it gives them more control over their operating capital and also allows them to offer a longer credit term to their shippers, which they can use as one of their unique selling propositions.

Favorable Leverage During Negotiations

All the advantages above combine to offer freight brokers better leverage during negotiations. For instance, flexible scheduling enables them to offer more favorable timelines to shippers.

Similarly, by waiving the intermediary fee, they can offer better pricing compared to freight brokers without dedicated fleets. Moreover, owning a fleet enables brokerage firms to enter multiple niches and diversify their operations.

As a result, they can offer a more complete or all-in-one solution for shippers with different shipping needs.

In addition, operating a dedicated fleet means brokers have vast knowledge related to the processes and expenses associated with the carrier function. Consequently, they can leverage this knowledge when outsourcing carriers and negotiating better deals and partnerships.

Depending on the type of freight services they offer, they can complement each other’s shortcomings and eliminate their pain points. For instance, a carrier with an excessive fleet looking for warehousing could benefit greatly from a carrier with larger facilities, but a limited fleet.

Similarly, they can work with other carriers in over-booked markets and take advantage of backhaul opportunities and additional profits on offer.

Finally, another advantage of owning a dedicated fleet is that it gives freight brokers the power to say no. In many cases, freight brokers have to bend and give in to carriers, especially during busier seasons or unpopular routes. In these situations, they decide the rates and whether or not to move cargo to or from a specific location.

Considerations For Owning a Fleet

While owning a dedicated fleet offers a host of advantages for freight brokers, there are many factors to consider before embarking on this transition and investing in trucks or other freight vehicles. The following are some of the major considerations.

Managing Fleet Expenses

Owning, operating, and maintaining a fleet of trucks is an expensive endeavor from the start, as there are various types of fixed and variable costs associated with it that have to be covered monthly.

Below, you’ll find a list featuring some of these costs:

- Truck loan repayments

- Insurance

- Permits

- Fuel

- Driver salaries

- Taxes

- Toll

- Repairs

- Maintenance

Managing these truck expenses requires a strategic blend of human and technological resources. For instance, you can opt for a transport management system (TMS) to streamline your operations and reduce different types of fixed and variable costs.

Moreover, you can also hire professionals or services for fleet management, tax filing, bookkeeping, maintenance, and other important functions.

Hiring Drivers

Drivers are an indispensable aspect of fleet ownership. They’re the most essential human resource group in any carrier business since they’re responsible for operating your commercial vehicles and transporting cargo to its destination safely and timely.

Hence, freight brokers with dedicated fleets have to go through a daunting recruiting, evaluating, and onboarding process to ensure they have reliable drivers handling their shipments.

Moreover, truck drivers are highly skilled professionals. Therefore, they usually demand a steep salary between $50,000 and $80,000 a year. Many drivers demand even higher salaries, depending on the requirements, skill level and the state they operate in.

Furthermore, training new drivers takes time and effort. This becomes a problem when a truck driver resigns and disrupts the supply chain process and delivery times. When this happens, many brokers have to deal with unavoidable losses as new drivers pick up the slack and slowly transition into their roles.

Optimizing Schedules & Routes

By transitioning into a freight brokerage firm with a dedicated fleet, you’d be responsible for planning and managing freight schedules. This means you’ll need to procure the required technologies, solutions, and human resources, such as electronic logging devices or engaging truck dispatchers, to carry out carrier functions smoothly.

Moreover, by offering a complete freight solution, you will no longer just be connecting shippers with carriers. You’ll also be responsible for handling cargo during transit and ensuring safe delivery, which introduces risk and liability.

It’s also important to note that it can be difficult to secure shippers expecting you to handle all of their shipments even though the routes are inefficient for you. For instance, many shippers want to move cargo to multiple destinations.

If you don’t operate on their required routes, they may not opt for your service. Even if they do, you would have to outsource shipment to other carriers, which can negatively affect your profitability.

Furthermore, by owning a dedicated fleet, you may have to limit yourself to a specific clientele, which could hinder your growth, especially if you are not able to manage it well.

Managing Outsourced Carrier’s Expectations

Once brokers integrate vertically and start offering a full freight solution, some carriers (including their existing ones) may stop working with them due to a conflict of interest.

In the past, freight brokers were merely charging a fee for helping them find shippers and maximize volume. Now, they’re competing with carriers directly.

Moreover, many outsourced carriers that remain onboard with full-service freight brokers may express concerns in anticipation of losing some business and demand higher charges.

Depending on the circumstances, it would be unwise for a broker to disrupt or discontinue their relationship with carriers, especially with those they’ve been working with for a long time.

In short, going down this route successfully may depend on their ability to manage carrier expectations. This could be as simple as being honest and transparent about their transformation plans and the new relationship dynamics.

While it’s inevitable that some carriers will stop working with brokers that procure a dedicated fleet, some may be willing to compromise. However, this will depend on multiple factors, such as the type of freight, quantity, routes, timelines, costs, etc.

If they don’t, brokers must find carriers on a short-term or long-term basis to replace them.

Assuming More Responsibilities

Finally, as a full-service freight solution, you have to comply with federal, state, and local freight transport laws related to owning and operating trucks. For instance, the Department of Transportation (DOT) regulates companies that transport goods.

Hence, you need to check all requirements with the DOT and the Federal Motor Carrier Safety Administration (FMSCA). You will also need to file an application with the Unified Carrier Registration (UCR) application.

Moreover, you’d also be liable as a contractual carrier and responsible for any incidents or accidents that occur during transport, such as safety violations, accidental deaths, property damage, etc.

Additionally, you’d also be accountable for freight damage, delayed or failed deliveries, and other trucking-related issues. Therefore, you have to consider all these compliance factors before adding dedicated carrier services to your freight brokerage operations.

Case Study

The following case study explains the difference between opting for a freight broker with a dedicated fleet versus a freight broker without one for a shipper importing a few containers of books from Chicago to their distribution warehouse in Kentucky:

| Description | Freight Broker A | Freight Broker B |

| No. of Truck Owned | 5 | 0 |

| Delivery Lead Time | 1-3 Business Days | 2-6 Business Days |

| Brokerage Fees | N/A | $200.00 |

| Trucking Fees | N/A | $3,925.00 |

| Total Fees | $3,950.00 | $4,125.00 |

| Credit Terms | 30 days | 14 days |

From the table, we can infer that opting for Freight Broker A is a much smarter choice. With a dedicated fleet of trucks, this freight brokerage service provider has full control over carrier operations.

As a result, this option offers a much better delivery lead time compared to Freight Broker B. Brokers without a dedicated fleet usually require more time to deliver goods because they’re dependent on third-party carriers’ schedules, rates, and other factors.

As a result, a lot of time goes into simply finding the right carrier to move goods from one destination to another. Secondly, Freight Broker A charges a combined fee which takes the total cost to move the cargo to $3,950.

In the freight industry, this is considered one of the best selling points for any broker as it builds a better overall perception of the service provider initially. By choosing Freight Broker B, the shipper would have to pay close to $200 more and wait up to three days longer for their shipment to arrive.

Finally, many shippers are also awaiting payments from other sources, meaning they might require more time to pay their broker. Hence, choosing freight broker A gives them more time and flexibility to complete the shipping payment since they offer better credit terms (30 days).

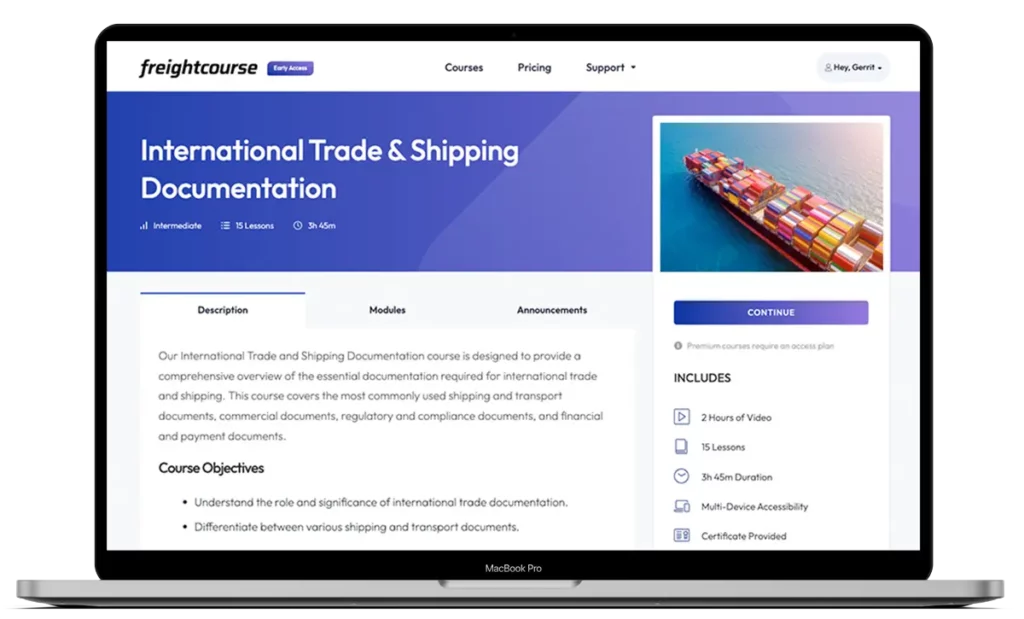

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us