Every trucking company employs different business metrics to quantify, track, monitor, assess, and improve its operations. The main purpose of these metrics is to help carriers and owner-operators view their performance over time and use it to optimize their logistics and supply chain operations with better practices and new solutions.

One of the most common metrics used in the trucking industry to evaluate financial success is the cost per mile. CPM in the trucking industry stands for Cost Per Mile and indicates much money each mile on the road hauling cargo costs a carrier or owner-operator.

By tracking the CPM, they can calculate their operational efficiency and set their shipment rates accordingly. Many trucking companies also use CPM to identify areas to reduce their expenses and optimize spending.

In this article, we’ll explain how to calculate the cost per mile and the essential cost components to consider during the evaluation. We’ll also talk about the main uses of CPM and the average cost per mile for truck drivers today.

How to Calculate the Cost Per Mile

On the surface, calculating the cost per mile for your truck or trucking company is straightforward and can be done using the formula below:

Cost Per Mile = Total Costs (Expenses) / Total Number of Traveled Miles

The total number of traveled miles is the amount of travel for a truck or the cumulative distance of all trucks in a geographical region (trucking route) in a specified period, typically a year.

Similarly, trucking expenses during the same period include fuel, truck payments, repairs and maintenance, taxes, penalties, layovers, administrative costs, and more. All these costs must be accounted for to get an accurate CPM value.

What Cost Components Are Considered?

Fortunately, the total number of miles traveled over a certain period is easily determined since they can be automatically tracked and are recorded on a truck’s electronic logging device (ELD).

However, calculating the total cost components can be a little more complex due to the vast number of expenses to consider, which we’ll explore in detail below.

General Business Costs

General costs are recurring overhead costs incurred to help a trucking business function. They typically include the following:

- Rental

- Licenses

- Utilities

Administrative Costs

Administrative costs are all costs associated with day-to-day operations and miscellaneous activities. For instance, most carriers subscribe to load boards to look for loads for their drivers to haul.

Moreover, they also need to procure software and staff to manage accounting and administrative tasks, such as taxes and payroll. Below is a broad list of the most common administrative costs trucking companies have to pay:

- Subscription services (Load boards, Digital Freight Matching Tools, etc.)

- Bookkeeping

- Cleaning

- Security

- Commission

Truck Expenses

Trucking expenses are all expenses related to owning and operating a truck for hauling cargo. For instance, the most recurring expenses truckers have to cover are those related to fuel and truck purchase or lease payments.

- Additional Resource: A Comprehensive List of Truck Driver Expenses

Drivers also have to obtain the appropriate licenses and documentation. They also need to ensure that their trucks are insured. Below is a list of the most common trucking expenses:

- Lease

- Fuel

- Tolls

- Maintenance

- Insurance

Salaries

Trucking companies typically hire independent truckers or drivers for their fleets full-time. Therefore, they have to pay them a salary. Companies also need to pay other directly employed staff, such as accountants, security personnel, truck dispatchers, and customer support professionals, to name a few.

In contrast, owner-operators need to pay a certain amount to themselves for their day-to-day expenses and other aspects of their lives.

What Is CPM Used For?

As mentioned earlier, cost per mile (CPM) is one of the most important metrics in the trucking industry, used for high-level decision-making. Below are some of the main reasons most modern trucking companies and owner-operators use CPM.

Establishing Payload Profitability

As mentioned above, most truckers have varying CPM rates due to different costs and expenses. Factors that contribute to CPM fluctuations are repairs & maintenance costs, dead miles, idling, bobtailing, detention, and layovers, to name a few.

By calculating CPM, they can identify the average profit they can make per mile. Moreover, they can also identify which routes, regions, customers, and trip types (line haul, short-haul, long-haul, etc.) are most profitable for their business model.

Strategizing Business Direction

By calculating and analyzing CPM, the owners and high-level managers of a carrier company use the insight to see how their trucking business is performing. More importantly, they can use the information to devise new operational strategies.

For example, if the CPM for a certain area (city, state, etc.) is low, they can expand their services, thereby increasing their loads and trips. Moreover, they can invest in new solutions and practices to reduce operational expenses.

For instance, owner-operators can equip their trucks with an auxiliary power unit (APU) to reduce idling and save hundreds of gallons of fuel annually to lower their CPM.

Tracking Cost Reduction Performance

Cost per mile is one of the key metrics trucking companies and owner-operators use to identify their business’s monthly, quarterly, and annual cost efficiency. They can track and identify cost trends during trips or periods to see how their decisions or practices affect overall performance levels.

Today, truckers have several opportunities to lower their expenses and CPM. For instance, if a trip on specific routes results in bobtailing, truckers can leverage the drop-and-hook method and leave multiple trailers in different drop yards to avoid load-free return legs.

What’s The Average CPM For Truck Drivers?

According to American Transportation Research Institute’s 2022 report, the 2021 average cost per mile for truck drivers in the US is around $1.855. Of course, some drivers may have varying CPM ratings (higher or lower) depending on their operation size, routes, assets, staff, and several other factors.

Case Study: Cost Per Mile Calculation

An owner-operator named John Smith operates mainly in Pennsylvania and hauls general cargo to neighboring states like Maryland, Delaware, and Ohio. John wants to calculate his cost per mile for the last month to determine how profitable his trucking business is.

He also wants to ensure that his rates per mile are set according to the average market rates. The tables below contain all his expenses in the previous month, along with miles traveled during this period.

Monthly Expenses

| Item | Cost | Time Frame |

| Load Board | $20 | Per month |

| Bookkeeping | $170 | Per month |

| Truck Lease | $2,200 | Per month |

| Fuel | $7,250 | Per month |

| Maintenance | $580 | Per month |

| Insurance | $255 | Per month |

| Salary | $8,200 | Per month |

| Total Costs | $18,675 | Per month |

Trip Log

| Item | Distance | Time Frame |

| Delaware | 4,107 Miles | Per month |

| Ohio | 3,268 Miles | Per month |

| Maryland | 5,139 Miles | Per month |

| Total Miles Travelled | 12,514 Miles | Per month |

Cost Per Mile Calculation

Considering both John’s expenses and trip log (total mileage traveled), let’s calculate the CPM, based on the formula that we shared earlier.

Cost Per Mile = $18,675 (total costs) / 12,514 (total miles) = $1.49

From this calculation, John can extract several valuable insights related to his operations and expenses to reduce his CPM of $1.49. For instance, John’s biggest monthly expense is fuel ($7,250). Therefore, reducing this amount could make a huge difference to his cost per mile.

John can utilize several strategies to reduce fuel expenses. For example, he can reduce unnecessary idling, drive at slower speeds, use fuel cards, and install an APU, among other solutions.

For example, reducing monthly fuel expenses by $1,000 can reduce his CPM using the following calculation:

- Revised Cost Per Mile = $17,675 (total costs)/12,514 (total miles) = $1.41

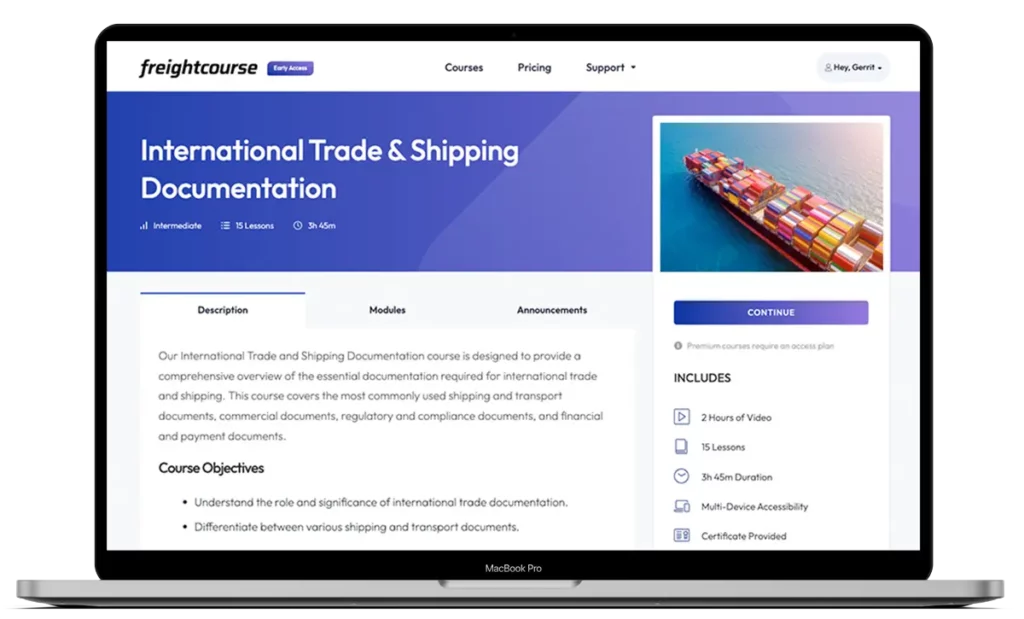

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us