Customs clearance plays an important part of the shipping process, especially in the United States. The U.S. Customs and Border Protection (CBP) has about 60,000 employees and a yearly budget of $15 billion to oversee all trade and customs activities.

In order to facilitate and fund the customs department in the United States, there are several charges that need to be paid for cargo clearance. One of these charges is the Merchandise Processing Fee, also known as MPF in short.

The Merchandise Processing Fee is charged from the U.S. Customs and Border Protection to the importer and is used to facilitate customs and trade compliance. The Merchandise Processing Fee is currently 0.3464% of the shipment value, with a minimum charge of $27.23 and a maximum of $528.33 per entry.

However, these rates are reviewed on an annual basis and can change over time. The Merchandise Processing Fee applies to air and ocean shipments and is assessed during the time of import entry filing.

Merchandise Processing Fee and Historical Rates

Below is a table showing the Merchandise Processing Fee over the last 4 years. While the ad valorem rate has remained the same, at 0.3464%, the minimum and maximum charges have increased on a yearly basis.

The current Merchandise Processing Fee is 0.3464% of the cargo value, with a minimum of $27.23 and a maximum of $528.33 per entry (as of 2020). More information can be found on the CBP website.

| Year | Ad Valorem Rate | Minimum MPF | Maximum MPF |

| 2017 | 0.3464% | $25.00 | $485.00 |

| 2018 | 0.3464% | $25.67 | $497.99 |

| 2019 | 0.3464% | $26.79 | $519.76 |

| 2020 | 0.3464% | $27.23 | $528.33 |

How To Calculate the Merchandise Processing Fee

Calculating the Merchandise Processing Fee is straightforward. All you need to do is consider the ad valorem fee, as well as the minimum and maximum amounts. Simply, multiply the value of the shipment by 0.3464%.

Merchandise Processing Fee = Cargo Value x 0.3464%

After that you’ll need to check if the total amount is below the minimum or above the maximum. If the MPF is below the minimum, then the minimum charge will apply.

On the other hand, if the total fee is above the maximum, then the maximum charge will apply. Below are two examples where the calculation is illustrated for better understanding.

- Example 1 – The value of the incoming shipment is $5,500.00. Based on this formula the calculated Merchandise Processing Fee will be $19.05 ($5,500.00 x 0,3464%). Since it is lower than the minimum, the final charges are $27.23.

- Example 2 – The value of the shipment is $120,000.00. The calculated MPF will be $415.68 ($120,000.00 x 0,3464%). This is because the fee is within the minimum and maximum chargeable amount and will therefore be charged at 0.3464%.

In summary, the threshold for the minimum and maximum cargo value is from $7,861 and $152,250.00, respectively.

It’s also important to note that the Merchandise Processing Fee is based only on the value of the shipment and should not include duty, freight, and insurance charges.

For What Type of Products is a Merchandise Processing Fee Charged?

A Merchandise Processing Fee is charged for most products. The U.S. Customs and Border Protection is mandated to collect this ad valorem fee for duty-free and dutiable shipments.

However, there are exceptions for certain products that fall under the Generalized System of Preferences. Products that are GSP-eligible are exempt from the merchandise processing fee.

Moreover, there are also certain countries and regions that have preferential trade agreements with the United States. Some of these countries are also either partially or fully exempt from MPF.

What Are Merchandise Processing Fee Exemptions?

The Merchandise Processing Fee is applicable to shipments coming from all origin countries, apart from a selected few that have preferential trade agreements with the United States. In these cases, the MPF is waived.

Below is a table that shows which countries have an exempt or partially exempt status with regards to the MPF.

| Country/Region | Trade Agreement | MPF Status |

| Africa | African Growth and Opportunity Act (AGOA) | Partially Exempt |

| Colombia | Colombia Trade Promotion Agreement (COTPA) | Exempt |

| Oman | Oman Free Trade Agreement (OMFTA) | Exempt |

| Australia | Australia Free Trade Agreement (AUFTA) | Exempt |

| Dominican Republic & Central America | Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) | Exempt |

| Singapore | Singapore Free Trade Agreement (SGFTA) | Exempt |

| Bahrain | Bahrain Free Trade Agreement (BHFTA) | Exempt |

| Panama | Panama Trade Promotion Agreement (PATPA) | Exempt |

| Carribean | Caribbean Basin Economic Recovery Act (CBERA) | Exempt |

| Carribean | Caribbean Basin Trade Partnership Act (CBTPA) | Exempt |

| Peru | Peru Trade Promotion Agreement (PETPA) | Exempt |

| Israel | Israel Free Trade Area Agreement (ILFTA) | Exempt |

| South Korean | Korea Free Trade Agreement (KORUS) | Exempt |

| Chile | Chile Free Trade Agreement (CLFTA) | Exempt |

| North America | North American Free Trade Agreement (NAFTA) | Exempt |

| Jordan | Jordan Free Trade Agreement (JOFTA) | Not Exempt |

| Morocco | Morocco Free Trade Agreement (MAFTA) | Not Exempt |

- Source: MPF and Preferential Trade Programs (August 1, 2018)

Before shipping to the United States, it is highly recommended to recheck all applicable import charges, regulations and documentary requirements to calculate the overall shipment cost.

Who Pays the Merchandise Processing Fee and How Is it Paid?

The MPF is payable by the importer with the exact value being calculated during the processing of the import customs entry. Payments are made in United States Dollars and are typically paid by bank draft, or cashier’s check and made out to the U.S. Customs and Border Protection.

Non-payment will lead to delays in on-time cargo release and will incur interest. There is also a possibility of sanctions and fines by the CBP.

How Did the Merchandise Processing Fee Come About?

On December 4, 2015, the Fixing America’s Surface Transportation Act (FAST Act) was signed into law.

In order to protect itself from inflation the Secretary of Treasury was tasked to collect user fees or payment in the form of the Merchandise Processing Fee. The basis of which was a study of the Consumer Price index for 12 months from June through May.

It was also planned to use the proceeds of this fee to offset the increasing overheads of the U.S. Customs and Border Protection. The CBP typically publishes a notice of fee adjustments 60 days before the implementation date.

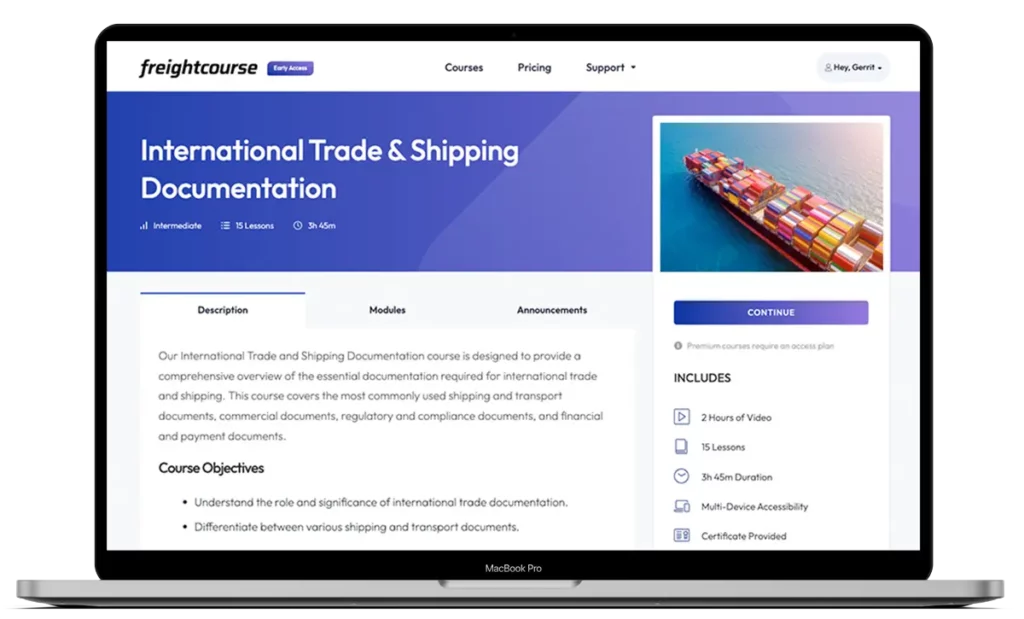

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us