The ocean freight market is often unpredictable, where rates, equipment, space and allocations can change abruptly. The same goes for manufacturing, as shippers face changing market conditions, production capacity challenges and various other uncertainties. Therefore, when shippers and carriers enter into a contract, they sometimes require a minimum quantity commitment.

A Minimum Quantity Commitment (MQC) is a mutual agreement between shippers (BCO) and carriers (NVOCC or VOCC) of a volume threshold that is shipped over a fixed contract period. This volume commitment is typically reflected in the service contract between both parties and may have penalties in the case they are not met.

In this article, we’ll be discussing the benefits of minimum quantity commitments for shippers and carriers, and explore how they are determined. This guide will also be complimented with a case study for better understanding.

What are the Benefits of MQCs?

As freight contracts typically have a validity of about 12 – 24 months, both the shipper and carrier need a form of commitment from each other. On the one hand, shippers would like to mainly secure the price and allocation with the selected ocean carrier.

On the other hand, the carriers also want to forecast volume so that they can practice accurate network planning and account for consistent shipping volumes. Below is a list of the most common benefits for having an MQC clause as part of the freight contract.

Benefit for Carriers:

Carriers could favor minimum quantity commitments mainly due network optimization, steady shipping volume and rate protection. However, in unfavorable market conditions, MCQ can also have the opposite effect.

- Volume Commitment: Carriers allocate volumes ahead of time, so that they can plan their vessel routing well in advance. Securing business with MQCs allows shipping lines to calculate vessel requirements and cargo movements more accurately.

- Rate Protection : Setting rates against an MQC ensures that the quoted rates are applied for the contract period, with a minimum committed volume. This is particularly important for NVOCCs as they are required to secure allocations with the underlying shipping lines (VOCCs), which rely on consistent volumes throughout the year.

Benefit for Shippers:

There are also important benefits for shippers that need to be considered. These benefits mainly revolve around price, equipment and space protection for the length of the contract period.

- Price Protection – Rates tend to be volatile, especially over a longer contract period. Having a minimum quantity commitment from carriers ensures that shippers are able to secure their price against the volume threshold throughout the contract.

- Space Allocation: Apart from securing rates, shippers are also able to have carriers commit to a minimum volume. This also means that they are less likely to request for additional spot quotes throughout the contract period.

- Equipment Protection – Through an MQC, shippers are given priority for needed container equipment. This is because during the RFQ stage, the carrier has considered the shipment volume and equipment type. However, most MQCs don’t mention container types, unless explicitly indicated.

As you can see, there are benefits for shippers and carriers. These benefits can favor either party, depending on the market situation. Let’s explore this concept in more detail.

Why Are Minimum Quantity Commitments Requested?

MQCs are typically requested from shippers, however they are also occasionally requested from carriers. Shippers typically launch an RFQ and provide carriers with either their forecasted or historical shipment volumes.

Carriers would then do their internal assessments and indicate their minimum quantity commitment, which in other words means how much volume they are committing to move on a monthly or yearly period.

A shipper can then lock the submitted rates and volumes in for the contract period, without having to worry about carrier space issues. This ‘guarantees’ them consistent volume over a longer period of time, which would most likely also result in less spot quotes.

However, this can also be risky for carriers. In the event of equipment and space shortages, where the market rates increase, a carrier would then still need to commit to the MQC as agreed in the contract and move those shipments according to the agreed rates.

It’s therefore important that shippers and carriers understand the market dynamics, in order to properly assess an appropriate MQC.

How Is an MQC determined By the Carrier?

As shippers often share their forecasted or historical volume, it’s up to the carrier to determine an appropriate MQC. A minimum quantity commitment that is too low, may rank them lower in the overall bid, and an MQC that is too aggressive may have potential implications in the future.

Therefore, a right balance of assessment is required. Typically, a carrier would assess the following:

- Reviewing port pairs – Carriers will check service offering between the port of loading and the port of discharge to determine the right ocean freight charges, as well as service availability.

- Bunker fuel fluctuations – This is one of the biggest factors that carriers consider when it comes to determining freight costs and MQCs. The Bunker Adjustment Factor (BAF) can rapidly change depending on the bunker prices, and is therefore important to take into account when it comes to determining a minimum quantity commitment.

- Service capabilities – Carriers also assess if they have the required equipment, routes, vessel and space to meet the customer’s request.

- Market conditions – The overall market situation can change over time and is important to consider. For example, port congestion and container shortage can become a challenge. This can influence ocean freight pricing, as well as the MQCs.

Do All Contracts Between Shippers and Carriers Have an MQC?

No, not all freight contracts have a minimum quantity commitment. In fact, MQCs are more common for shippers with larger sea freight volumes. This is because they have a higher demand for space and more consistent volumes.

MQCs don’t make much sense for shippers who have:

- Irregular shipping volume

- Small shipping volume

- No fixed carriers

- Spot quote reliance

- No tenders / RFQs

In these cases, it may be more suitable for a shipper to forgo an MQC, as most shipping lines may not want to commit to one. Instead shippers who fit the above profile may instead want to:

- Check for the occasional spot rates, which are more competitive than the shipping tariff rates (only suitable in favorable market conditions)

- Work with accredited freight forwarders who are able to service smaller volumes

- Adjust their shipment profile to a higher degree of consistency or facilitate more overall shipping volume

- Launch RFQs that specifically mention that carriers must indicate an MQC upon rate submission

What Is the Penalty If a Shipper Misses the Minimum Quantity Commitment Threshold?

A freight contract may or may not have a penalty scheme for failing to fulfil minimum quantity commitments. Therefore, it’s important to ensure that this information is clear during the RFQ launch and at the contract signing stage.

There are no set standards on the compensation for failing to adhere to MQC agreements. Typically, when shippers fail to meet MQCs they would compensate the carrier for the difference of volume committed and shipped.

On the other hand, carriers who fail their MQC commitment are sometimes asked to pay the difference of additional freight cost, if the shipper has to select another carrier or other modes of transport.

Most commonly, shippers and carriers tend to negotiate depending on the market situation. The negotiations can be a result of market uncertainty, space and equipment issues, or even production issues.

These discussions can lead to a commitment of future volume, general rate increases (GRI), peak season surcharges (PSS), or any other type of charge to facilitate a fair outcome for both parties.

Case Study: Rate Submission with MQC

The table below shows an example of a shipper who is launching a tender for 26,000 TEUs a year from Port Klang, Malaysia to Houston, United States. The clause within the RFQ document states that all bidders are required to indicate an MQC per month, in TEUs.

Carriers then assess this internally and submit rates accordingly. Below is an example of a carrier’s rate submission for the scenario mentioned above.

| Port Klang to Houston, USA | Contract Period: June 2021 – June 2022 |

| Container Size | 20’ |

| Ocean Freight | USD 2,500.00 |

| THC | MYR 460.00 |

| Documentation Fee | MYR 200.00 |

| Seal Fee | MYR 18.00 |

| Minimum Quantity Commitment (MQC) | 2,500 TEUs per month |

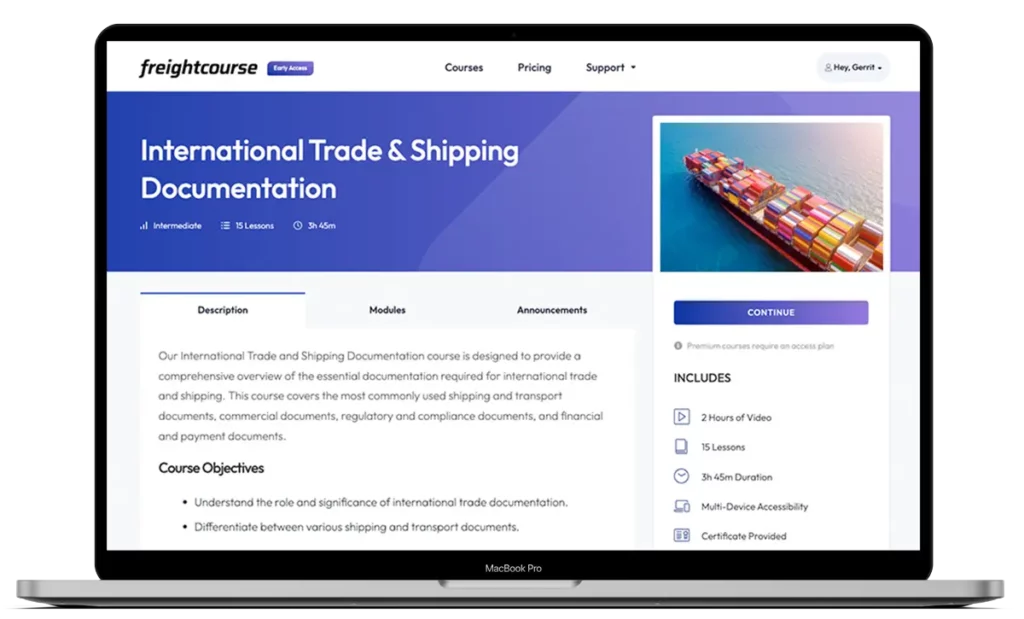

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us