An Importer Security Filing, or ISF in short, is a mandatory document that is filed electronically to the Customs and Border Protection (CBP) Department in the U.S. by the owner of the goods, purchaser, consignee, freight forwarding agent or customs broker.

The submitted ISF information is used by the CBP to screen incoming cargo and implement controls, in order to prevent potential security risks.

An ISF only applies to shipments arriving via an ocean vessel that’s discharging at any U.S. port and does not apply to other modes of transportation. The Importer Security Filing must be submitted 24 before the containers are loaded onto the vessel at the origin port.

Here are the topics we’ll cover in this article:

- What is an Importer Security Filing?

- What Documents are Required for an ISF?

- When Does an ISF Need to Be Filed?

- Who Files the ISF?

- What Is an ISF Bond?

- What are the Penalties for Failing to Submit an ISF?

- How to Prevent ISF Penalties?

- What are the Exceptions to ISF?

- Why are Importer Security Filings Important?

There are several misconceptions about Importer Security Filings, so let’s explore the ISF requirements in more detail.

What is an Importer Security Filing (ISF)?

An Importer Security Filing (ISF) is an electronically filed document that is submitted to the Customs and Border Protection Department in the United States.

In reference to Security and Accountability for Every (SAFE) Port Act of 2006, the Secretary of Homeland Security through the Commissioner of CBP, is mandated to find ways to enhance security.

In this case, it was stipulated that the ISF importer, cargo owner, consignee, freight forwarder or appointed customs broker is required to submit specific data elements (customs and cargo information) to the Customs and Border Protection Department in the United States.

The rule has come to be known as the “10+2” where 10 data elements are to be submitted by the importer or its authorized representatives and 2 data elements are to be submitted by the steamship line. The term was subsequently generalized as Importer Security Filing, and in short is known as ISF.

For more information on the background of ISF, visit the official Customs and Border Protection publication.

What Data Elements are Required for an ISF?

To successfully file an Import Security Filing, ten (10) data elements need to be submitted to the Customs and Border Protection Department in the U.S. by the importer or an appointed representative.

Two (2) additional data elements will be submitted by the respective ocean carriers. These data elements (10+2) can be found below.

10 Data Elements (Submitted by the Importer)

There are 10 data elements that the importer or the appointed party is required to obtain and submit.

- Exporter / seller of the goods

- Importer / buyer of the goods

- Importer of record number / Foreign Trade Zone (FTZ) applicant identification number

- Consignee number/s

- Manufacturer or supplier

- Ship to party

- Country of origin

- Commodity Harmonized Tariff Schedule of the United States (HTSUS number)

- Container stuffing location

- Consolidator (Stuffer)

+2 Data Elements (Submitted by the Ocean Carriers)

There are also 2 additional data elements that the ocean carrier is required to submit. This is done from their end and you’ll only need to ensure the submission of the first 10 data elements.

- Vessel stowage plan

- Container status messages

When Does an ISF Need to Be Filed?

An ISF needs to be submitted electronically 24 hours prior to the container being loaded onto the vessel at the origin port, before departing for the United States.

There is no flexibility around this timeline. Therefore, it’s extremely important to prepare the required information beforehand.

Who Files the ISF?

The Importer to the United States or its designated representatives are required to submit the Import Security Filing. The ISF importer or an appointed party such as the goods owner, purchaser, consignee, freight forwarding agent, or licensed customs broker can do the submission.

There are several parties who can submit the ISF to the Customs and Border Protection Department. Therefore, it’s important to identify well in advance who the nominated entity is.

What Is an ISF Bond?

Importers are required to have an ISF Bond with United States Customs. This will guarantee payment benefiting United States Customs for possible violations or non-compliance to ISF regulations.

There are two types of Customs Bonds:

- Continuous Transaction Bonds – applies to all import transactions within 12 months starting from the time the bond is approved and effective

- Single Entry Bonds – applies to all import transactions on a per entry basis only

What are the Penalties for Failing to Submit an ISF?

Submitting an Importer Security Filing is mandatory and needs to be done in advance. Failure to comply with ISF submission can result in:

- Monetary penalty

- Delay in releasing and delivery of cargo

- Inspection of cargo by local authorities

There can also be a monetary penalty. The United States Customs and Border Protection can assess a fine of $5,000.00 per infraction or per shipment, based on the following violations:

- Failure to file an ISF

- Late filing of an ISF

- Incomplete filing of an ISF

- Failure to withdraw an ISF

- Failure to ensure ISF filing matches Bill of Lading.

The penalty for failing to submit and for incorrect or incomplete filing is $5,000.00 and can result in additional delivery delays and further customs inspections.

How to Prevent ISF Penalties?

There are several ways and best practices to avoid paying penalties to the United States Customs and Border Protection. Here are some simple steps that you can take :

- Work closely with your shipper.

- Schedule a knowledge transfer and discuss the penalties and scenarios involved for non-compliance to ISF rules and regulations.

- Make it a habit to have your team check the requirements needed to make a successful ISF in order to avoid unnecessary fines.

- Readily have ISF templates for easy submission and eventual filing.

- An ISF can be amended many times so long it’s finalized before the cargo arrives in the United States. The more important rule is to file the ISF in time.

What are the Exceptions to ISF?

Breakbulk cargo is exempt from the 24 hour rule prior to the shipment being loaded onto the vessel. Instead, the ISF for breakbulk cargo is required to be submitted at least 24 hours prior to arrival at the intended port of discharge in the United States.

Why are Importer Security Filings Important?

According to the Federal Register / Vol. 73, No. 228, the Import Security Filing aims to enhance security against terrorism, smuggling, weapons, and contraband items.

The information required by the CBP will be sent by the importer prior to loading of cargo via data interchange system. The information provided will then be used by the CBP to check incoming cargo and implement appropriate controls to prevent security risks.

Importer Security Filings fulfill the requirements of the Security and Accountability for Every (SAFE) Port Act of 2006 and Trade Act of 2002. Therefore, it’s extremely important to adhere to the required ISF submission guidelines.

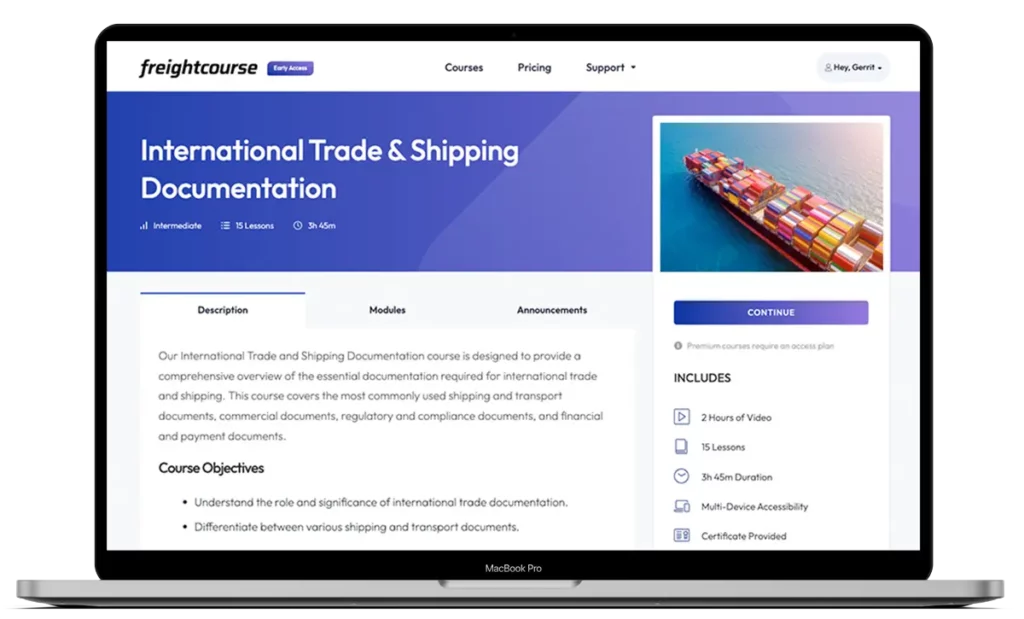

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us