There are various ways for buyers and sellers to protect themselves during business transactions where freight is involved. One of these ways is through an arrangement known as Cash Against Documents.

Cash Against Documents (CAD), also known as Documents Against Payment, is an agreement between a buyer and a seller, where the shipping documents such as the bill of lading, are only released to the buyer or consignee, against a payment.

Ensuring that shipping documents are only released against an actual payment protects both buyers and sellers, as both party’s responsibilities are equally fulfilled at the time of exchange. This type of transaction is typically facilitated by a financial institution such as a bank or a third party agent.

In this article, we will explore the concept of Cash Against Documents and discuss what the advantages and disadvantages are for both sellers and buyers. We will also highlight commonly used scenarios when a CAD term should be explored and what the best practices for both parties are.

When Is Cash Against Documents Used?

Cash Against Documents is used by both parties to protect themselves in the event the seller does not ship the goods or the buyer does not pay. Shippers can ensure that the document of title (bill of lading) is only transferred to the buyer once the full payment has been made.

On the other hand, the buyers can rest assured that the shipment has been fulfilled and is available the moment that the payment is made. Let’s take a look at some scenarios when CAD arrangements are most suitable:

- The buyer doesn’t have a long history with the seller – A seller/shipper may not have dealt with the purchasing party many times before. In order to guarantee that the cargo is only released against a payment, a CAD may be appropriate.

- Buyer has a bad credit history – An exporter may come across a buyer that has a history of late payments or where a transaction did not follow through.

- Buyer is a new company – The buyer has no or few business dealings with a new customer. Time is needed before an importer can establish credibility and eventually request more common credit terms.

- Larger orders – Large orders may also mean that the seller may have to outlay more money, which increases their risk. Cash against Documents can act as a protection for the increased risk and only guarantees release of the documents and cargo if the buyer has made the full payment.

As can be seen, CAD terms are commonly used for business transactions that have a tendency to be more risky for the seller. This is because sellers have to fulfill part of their duties, before the buyers do.

The seller may find themselves in an unfavorable position if the buyer is unable or unwilling to complete the purchase. Therefore, it’s in the seller’s best interest to adequately vet the buyer and its ability to pay.

What Are the Advantages and Benefits of Cash Against Documents?

In any type of agreement, there are bound to be advantages and disadvantages for all parties. The main benefits for Cash Against Documents is that it’s relatively hassle free, requires less setting up, is low cost compared to other alternatives and guarantees that cargo is only released after the payment has been made.

There are also various other benefits that the CAD term offers to both parties. Let’s take a closer look:

- No Letter of Credit Required – A Letter of Credit (LC) may not always be granted by financial institutions, especially for smaller businesses. CAD terms do not require any Letter or Credit.

- Easy Setup – CAD is easy to implement because the only requirement is full payment of the order before documents are released. However, it’s important to note that not all banks are able to facilitate this. The ones that do can usually perform this without much of a hassle.

- Low-Cost Method – Banks or agents who facilitate Cash Against Documents terms usually don’t charge high fees. They are typically cheaper than Letter of Credit arrangements and are a fixed fee, compared to a percentage of the sale value.

- Guaranteed Release After Payment – The shipper remains the owner of the goods until the buyer has completed the payment to the bank. If the payment is not successful, the buyer does not receive the document of title and cannot claim ownership of the cargo.

- Banks Are Not in Control – Banks only need to wait for the payment of the buyer under the instructions of the seller. No other conditions prevent the shipper from getting paid or the consignee from getting the documents. Other than processing payments and releasing shipping documents, banks are not required to do any additional tasks.

What Are The Disadvantages and Risks of Cash Against Documents?

There are also several disadvantages that a Cash Against Documents term has. These disadvantages are mainly a concern for sellers, as they have to manufacture and fulfil the cargo first, before potentially getting paid.

This could mean that the buyer may ultimately not be able or willing to transfer the payment. Conversely, the buyer is also not able to inspect the cargo before transferring the payment.

- No Guarantee of Goods Acceptance – The buyer may ultimately not be able to or want to complete the payment. This means that the shipper/seller has already fulfilled and sometimes even shipped the order and the buyer may ultimately decide to reject the goods and refuse payment.

- Seller Doesn’t Receive Payment Before Shipping – The shipper has already incurred expenses by manufacturing the goods and can only expect payment when the shipment has already departed. In a worst-case scenario, the seller may have to arrange for the return shipment.

- Buyer Can’t Inspect Goods Before Payment – The buyer is not able to inspect the cargo before transferring the payment to the bank. This also means that the buyer will only be able to assess the quality of the goods after having physically received them.

- Bank May Erroneously Release Documents – Administrative errors may occur if the bank is careless in handling documents or failing to understand the process. They may accidentally release the shipping documents before the payment has been received or if only a partial payment was made.

What Is the Process for Shipments With Cash Against Document Terms?

When it comes to arranging Cash Against Document terms, the process is relatively simple and straightforward. However, it’s always best to align with the other party before any form of agreement and business transaction.

- Both buyer and seller agree on the CAD terms and responsibilities are clearly defined

- Buyer manufactures, fulfills and ships goods within the agreed timeframe

- Upon vessel departure, the shipper must settle all origin charges and secure the original bill of lading immediately. Once completed, the original bill of lading is handed over to the exporters bank.

- The exporters bank then sends the original bill of lading to the importers bank.

- Upon cargo arrival, the seller is informed and is instructed to transfer the agreed amount through their nominated bank.

- The seller’s bank is now able to release the original bill of lading to the seller in lieu of payment.

- The consignee or its authorized customs broker proceeds with import customs clearance and final delivery to the receiving location.

- The importer’s bank remits the money back to the exporters bank and deducts a service fee.

- Lastly, the exporters bank receives the payment and releases it to the seller, after taking a service fee.

Tips for Buyers and Sellers Using Cash Against Document Terms?

It’s important that both parties understand CAD terms fully, before starting any business transaction or agreement. Here are some tips that both buyers and sellers can benefit from:

- Set Clear Expectations – Sellers and buyers should clearly define the order and shipping details. Timelines, quality and quantities, as well as all other details should be agreed beforehand.

- Communicate Transparently – All details of the shipment from booking to shipping should be agreed upon and communicated between buyer and seller. Everything should be kept in writing and understood so that potential misalignments are avoided. If there is a need to clarify, ensure that all lines of communication are open.

- Understand the CAD Process – It’s important to understand that Cash Against Document is a payment term and not an Incoterm. Therefore, both seller and buyer should ensure to understand the CAD process completely and also align with their respective banks accordingly.

- Select Reputable Financial Institutions – It’s encouraged to engage only reputable financial institutions and ask if a Cash Against Documents term is something they can work with. Ensure that they are aware of the process and have them recite all roles and responsibilities.

- Understand the Risks – Research about the company you are dealing with carefully and thoroughly. It may even be advantageous to start with a smaller order so that both parties can build a strong business relationship over time. It’s also important for buyers and sellers to understand the potential risks of this term.

It’s always encouraged to do due diligence about the parties that you’re dealing with and that both parties understand the processes completely. Therefore, communicate openly, build trust and offer support when needed.

Cash Against Documents vs Document Against Payment

Cash Against Documents and Document Against Payment can safely be used interchangeably as they refer to the same term of payment. With both terms, the bill of lading or any other document of title is only handed over to the buyer, once the payment has been made.

Cash Against Documents vs Letter of Credit

There are fundamental differences between Cash Against Document and Letter of Credit terms. When it comes to processing, Letters of Credit are initiated by the consignee while shippers initiate the process when it comes to Cash Against Documents.

There is also a clear difference between the responsibilities of banks. With CAD terms, the bank is instructed to release the bill of lading once the payment has been transferred from the buyer.

However, with Letters of Credits, the banks are tasked to check conditions before the actual payout occurs. Therefore, banks have a less substantial role when it comes to Cash Against Document terms and the onus is on the buyer and seller instead.

Cash Against Documents is also a more cost-effective term. Banks typically charge a service fee of about 0.5% to 2% of the sales price for Letters of Credit, whereas CAD terms are substantially more affordable and are typically charged a fixed fee.

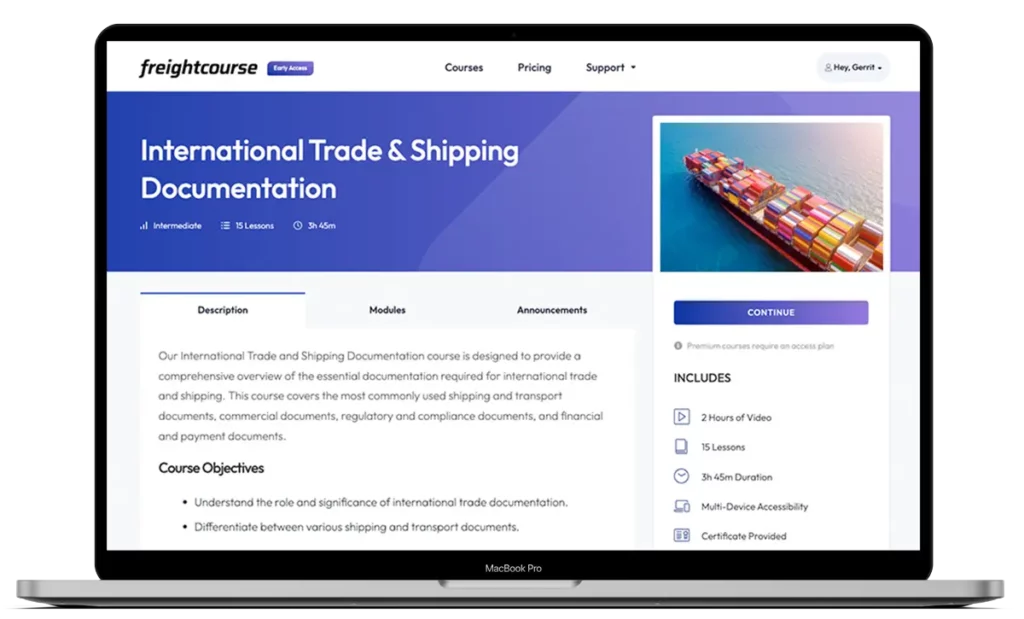

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us