In any type of personal or business transaction, there are always at least two parties: a buyer and a seller. Depending on the buying and shipping arrangements, an order can have various payment terms. A common one is cash with order.

Cash With Order (CWO), sometimes also known as cash on order is a payment term where the buyer is expected to make the payment at the time of placing the order. This payment term is similar to payment in advance or prepayment.

This means that with a CWO payment term, the seller only processes, fulfills and ships the order after the payment has been received. In this article, we’ll take a closer look at when a cash with order term makes most sense and what benefits and risks are presented.

When is Cash with Order Used?

Cash with order is commonly used for business-to-consumer (B2C) and business-to-business (B2B) transactions. Nearly all consumer purchases, whether offline through over-the-counter and in-store purchases or online purchases through online marketplaces like Amazon have cash with order terms.

This means that buyers pay in cash or through credit/debit when placing the order. The CWO payment terms are also common for certain types of B2B orders. When businesses make purchases, they would have to settle the payment, before the seller starts the order fulfilment process.

For B2B transactions, cash with order is not typical, yet occurs from time to time, especially with smaller order quantities or companies who do not have a longstanding business relationship. Businesses who have regular dealing typically have credit terms, especially larger multinational companies. (MNCs)

What are the Benefits of Cash with Order?

Different payment terms carry different benefits and risks. Depending on the role and type of the business, the nature of relationship and cash flow of a company, a cash with order (CWO) payment term may be advantageous.

Payments Don’t Need to be Cleared

Payments in cash or via bank do not require any form of clearance, as the remittance of funds happens immediately. Setting up credit facilities usually takes time and companies need to assess the credit worthiness of buyers.

This is similar to payment by cheque, compared to cash. Cheque payments require roughly 2 – 3 business days for clearance.

Faster Processing Times

With CWO payments, sellers can also process the order fulfilment right away, without having to wait for payment clearances. As there is no need for payment verification, orders also get shipped faster.

Ease of Business

Paying cash on order is also more practical and less complex, as the payment is issued at the same time the order is placed. This enables the seller to process and the buyer to receive the orders faster.

What are the Risks of Cash with Order Payments?

There are also potential risks with the CWO payment term. As the buyer is fulfilling his obligations before the seller, the buyer is taking on more risk.

Difficulty of Issuing Refunds

Once the buyer receives the goods and finds out that it’s not according to specification, it would be difficult to issue refunds. Cash with order terms usually don’t have refund policies in the sales contract and if they do, they typically only cover limited compensation. Therefore, it’s best to only consider this term with smaller orders.

Limited Escrow Possibilities

The buyer needs to rely on the seller to fulfill the order. If things don’t go according to plan, there are very limited escrow services available to ensure that money paid will result in a fulfilled order. Transactions under a CWO term generally rely on the buyer’s trust toward the seller.

Useful Tips When Buying on CWO Terms

Taking into account the benefits and risks of the cash with order terms, here are some useful tips that should be considered.

- Have a Purchase Agreement: The buyer of goods or services should diligently check and verify the scope of work and responsibilities between both parties. Larger purchases need to be meticulously examined to avoid orders that are not according to expectation or possibly returned due to misunderstanding. Therefore, it’s always best to have a purchase agreement that clearly outlines the responsibilities and expectations between both parties.

- Do Background Checks: Buyers should do background checks and get to know their sellers. Depending on what a buyer needs, ordering in smaller quantities or low-order amounts can be a good way to start. This way, the supplier’s reliability can be assessed.

- Ensure to Check Refund Policies: Under CWO terms, it can be difficult to secure refunds. Sellers would already have spent on materials and labor to fulfill the order. In the event a refund is necessary, ensure that you build a refund policy in the purchase agreement. Disputing payments may also be difficult with cash payments, without a payment processor or escrow service.

- Practice Good Cash Flow Management: Ensure that you have good cash flow management as a buyer to facilitate cash payments when placing the order. This is important with CWO payment terms and the money is remitted at the time the order is placed, compared to other payment terms on credit.

Cash with Order vs Prepayment or Cash/Payment in Advance

Cash with order, prepayment and cash or payment in advance require the buyer to settle the payment at the same time of placing the order. Therefore these payment terms are similar. However, the type of payment may differ (cash, bank transfer, debit/credit card).

Cash with Order vs Credit Term Payments

The main difference between cash with order and credit terms is that CWO payments require immediate payment settlement, whereas credit terms allow the buyer to remit the payment after the order/invoice date.

An example of this would be “net 30” or “net 45”, where the buyer only pays for the order 30 or 45 days after the invoice date.

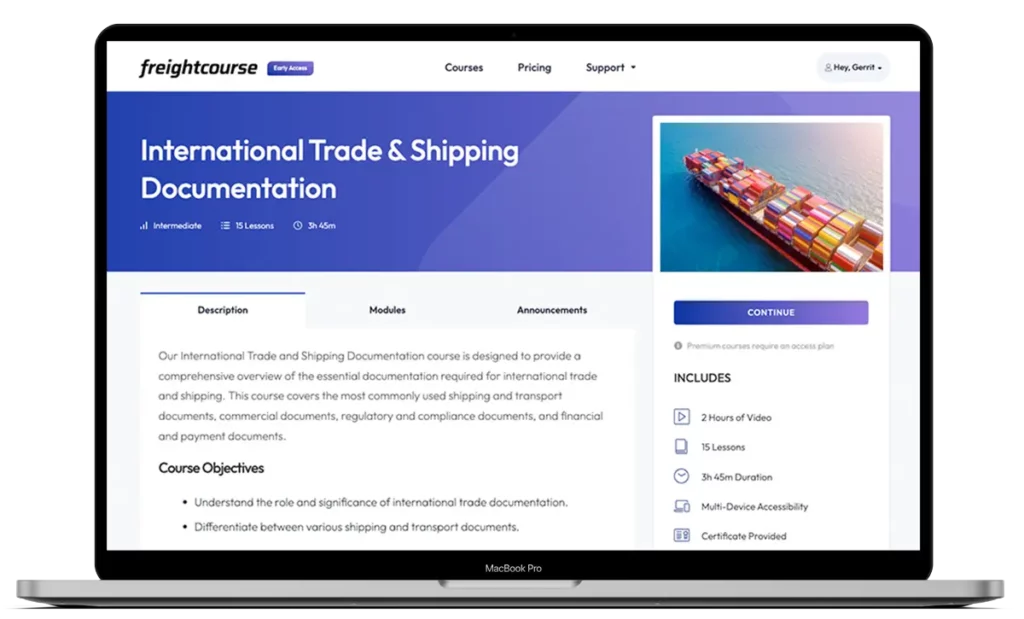

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us