When moving freight through a carrier using various different shipping methods, you’ll typically see a column that indicates a ‘Declared Value for Carriage’. The concept of cargo value is often not understood and one of the most common questions is why a carrier requires this information.

The Declared Value for Carriage is a value that is placed on the goods by the shipper. This value is indicated in a currency and is submitted to the carrier to determine essential shipping information.

On the one hand, it’s used by customs authorities during the import customs clearance process, in order to establish applicable duties and taxes. On the other hand, it’s used by the carriers as a means to establish liability coverage from possible loss, damage, or delay of cargo.

In this article, we’ll be taking a closer look at what declared value for carriage means in shipping and how this differs from cargo insurance.

On What Documents are Declared Values for Carriage Found?

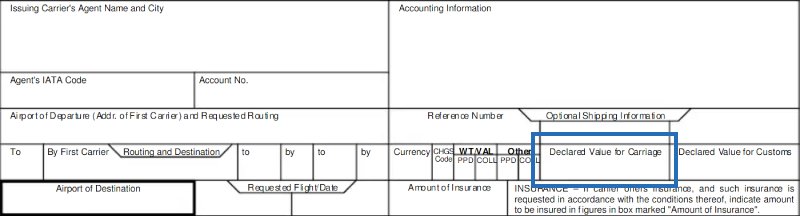

Value declaration of cargo is typically mandatory as import taxes and liability are assessed through the indicated amount. Therefore, it is part of the overall shipping documentation and is commonly found on contracts of carriage, such as a bill of lading and an airway bill or on commercial invoices.

- Bill of Lading – The declared value can sometimes be found on the front of the BL, specifically the ad valorem bill of lading. While it’s not presented on all BLs, the cargo value is also indicated in the commercial invoice that is issued by the shipper.

- Airway bill – The declared value is also found on the airway bill. One of the purposes of indicating it here is for the local customs to take note of the cargo value instead of searching through the underlying documents.

- Courier – It’s also a requirement for courier services and is used to determine their total liability, in the case of negligence or mishandling. It’s often found in its own field and is mandatory.

- Road / Rail Transportation – Similar to all other modes of transport, the cargo value is also often found on road and rail carriage documents, as well as the commercial invoice.

Difference between Declared Value for Carriage and Cargo Insurance?

From the above definition we’ve learned that the declared value for carriage serves as an indicator to the carrier for establishing their liability. This is because a contract for carriage ensures that a shipment is transported from one location to another.

However, the declared value for carriage should not be confused with cargo insurance. Liability through a declared value for carriage and cargo insurance are not the same thing. Let’s explore the differences in a little more detail.

A cargo insurance typically guarantees compensation against loss or damage, through the payment of a premium by the shipper or consignee. Many carriers provide shipping insurance to offset risk of cargo loss or damage.

However not all carriers provide insurance. Couriers and express services like FedEx, UPS or DHL typically don’t offer insurance for small consignments. Instead, they use the declared value for carriage, which usually has a limit. The higher the declared value, the higher the cost.

What are the Exemptions and Limitations of Declared Value Coverage?

When it comes to assessing liability through the declared value for carriage, there are certain exemptions. There are exemptions based on certain situations or conditions, as well as cargo type.

Conditional Exclusions

Conditional exclusions are not covered by carriers because they are deemed out of control or responsibility.

- Act or Omission of the Shipper, Owner, or Consignee – if the goods were damaged through any activity from the shipper, owner or consignee, the carrier will not accept liability. This is because the carrier has not caused damage or loss to the cargo, and is therefore not responsible.

- Nuclear/Radioactive Contamination – if the cargo is exposed to any radioactive materials or is classified as one, it’s also not covered.

- Regulatory Customs Hold or Inspections– if at any time local customs or government authorities seize cargo or deem it to be under quarantine, no claims can be made against the carrier.

- War Risks and other Political Risks – if the cargo is damaged or lost due to war or other political exposures, the carrier will not claim liability.

Cargo Type Exclusions

The following types of cargo are given limited or no coverage. This is because these commodities are perishable, deemed not suitable or are sensitive to climate and temperature.

- High-Value Cargo – This is subject to carrier classification. Some examples include pharmaceuticals, hi-tech products, or goods of a high cultural significance (fine art, sculptures, others).

- Live Animals – cargo owners can expect limited to no liability coverage for animals and pets. There are many things to consider from packing to the health condition of the animals.

- Human Remains – human remains are also not covered, mainly due to unsuitability and difficulty to establish a value.

- Highly Deteriorating and Perishable Commodities – due to temperature changes or change of climate. Some examples include medicines or certain types of food.

- Equipment for Repair – Items that are shipped, which require repair, as they are known to be already damaged.

As can be seen from the list of exemptions, it’s important to understand a carrier’s liability coverage and their respective limitations. Therefore, it’s best to declare the goods which are being shipped accurately, so that your transporter is able to assess their coverage.

Not only will this help the carrier to determine their maximum liability, but it will also help the shipper or consignee to understand the liability coverage from the carrier and calculate the additional shipping costs.

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us