Truckers, typically owner-operators, often face challenges in maximizing their income and securing profitable loads. One of the best alternatives to that is to create a passive income stream by leasing their semi-truck to another company. Some truckers make anywhere between $50,000 to $150,000 per year, depending on the type of truck, lease terms, and more.

This consistent income-generating opportunity is often untapped, as many truckers aren’t aware or know how to do this. Truckers who lease their trucks to another company retain ownership of their equipment.

While they continue to earn from their assets without hauling loads, this passive income may not be as lucrative as taking on jobs themselves, but it provides them with a steady income when they aren’t using their truck for longer periods.

In this article, we’ll delve into the details of semi-truck leasing, providing valuable insights and essential considerations to help you navigate this innovative strategy successfully.

Process of Leasing Your Semi-Truck to Other Companies

The modern trucking industry consists of various types of lessees, including owner-operators, companies, freight forwarders, and even carriers. Regardless of your truck model, there is enough demand in the market for you to lease your truck if you follow the right steps and create the required visibility.

1. Assess Your Semi-Truck

Before leasing your truck to any company, you want to ensure it’s in good working condition and complies with legal and safety requirements, as lessees will be paying you to use your truck. Therefore, its maintenance and inspections should be up to date.

Secondly, leasing rates vary according to your truck’s make and model, condition, market demand, location, and other factors. So, take your time to determine its value to secure the best deal possible.

2. Determine the Leasing Terms

After the assessment, you should decide on the leasing terms. While this list may not be exhaustive for some, it covers the most common aspects that should be considered.

- Rate – One of the most important aspects is to decide how much you want to lease your truck for. As leasing terms may be for a long period, it should be a figure that you can accept. It needs to also account for any upkeep costs that you may need to undertake throughout the entire leasing period.

- Duration – Determine how long you want to lease your truck (daily, weekly, monthly, quarterly, or yearly.). You can also lease it according to seasons or market demands.

- Special Conditions – Your leasing terms should outline the truck’s use, operating boundaries, and other details. For instance, you can lease it for short-hauls only or long-hauls with a mileage limit.

- Payment Terms – Decide when and how you want to be paid by lessees. For instance, you can opt for monthly, bi-weekly, quarterly, annual, or balloon payments. Similarly, detail how you would like to receive the money such as bank transfers, checks, or cash payments.

- Inclusions – Ask yourself, do you want the lessee to handle repairs and maintenance? Or do you want to manage these essential processes in-house? Your decision will affect the leasing rates. Most owner-operators charge a higher rate for including maintenance and repairs in the leasing terms.

- Lease-Break – Your leasing terms should also include a termination clause and an early termination fee. This will facilitate smooth dispute resolutions should any arise during the lease.

3. List Your Truck for Leasing

Once you’ve determined your leasing terms, you must then reach potential companies or individuals interested in leasing your semi-truck. You can advertise your truck for lease using multiple channels, including:

- Classified Ads

- Trucking Forums

- Trucking Websites

- Outreach

- Advertisements

- Referrals

Ensure you include important details in your listings, including the type of truck, year, make and model, duration options, payment terms, rates, and inclusions (repairs and maintenance).

Also, make sure to include any relevant images so that potential lessees can evaluate its condition and get a better understanding of your truck. Below are some images of a truck lease listing for reference.

By providing sufficient information to potential lessees, you can accelerate the decision-making process and foster a sense of transparency through proactive, open communication. Finally, include your contact details and preferred contact hours.

4. Screen Potential Lessees

Ideally, you want your lessee to be responsible and take good care of your assets. Moreover, you want to ensure they pay their dues on time so you have a consistent cash flow.

Therefore, you must do your due diligence and conduct a thorough screening and vetting process to assess their reliability and financial stability. The easiest way is to check their credit history, past leasing history, and company background.

You can also ask for references from clients, vendors, or other trucking companies or owner-operators. Before handing over the keys to your truck, ask them why they want to lease.

Some could be starting a new trucking business, while others could be transitioning to owner-operators or expanding their fleet. By understanding their motivation, you can make a more informed decision.

5. Negotiate Lease Terms

Semi-truck leasing isn’t always a straightforward process. In most cases, you must negotiate the lease agreement terms with interested parties. After all, they have their certain needs and preferences.

So, take your time to discuss rates, duration, payment terms, inclusions, termination, and special conditions. Market factors, such as demand, availability, and competition will impact your decision and leverage.

Therefore, it’s best to be flexible and negotiate favorable terms for both parties, while ensuring that your costs are covered to avoid any potential losses.

6. Create a Lease Agreement

Once you’ve come to an agreement with an interested party, you can draft the lease agreement. Carefully outline the roles and responsibilities of both parties. Include pickup and return locations, maintenance conditions, and route limitations, among other details. You may need to engage a lawyer if require legal advice on how to draft a lease agreement.

7. Sign the Lease Agreement

Once the lease agreement is ready, both parties can sign and take their copies for reference. The signed copies should be dated with the location and the lessor’s name. Ideally, you should do this in the presence of a legal professional. Keep in mind that the document would be legally binding.

Why You Should Consider Leasing Your Truck to a Company

There are various reasons why you should consider leasing your truck to a company if you aren’t going to use it for an extended period. Let’s explore them in more detail below.

- Reduces Truck Expenses – Owning a semi-truck costs money. Owners must manage various truck expenses, including fuel, oil changes, repairs, and maintenance. Moreover, having a truck sit in a yard reduces its utilization rate and increases the opportunity cost of not hauling cargo. Hence, leasing to a company or third party with regular shipments is an excellent strategy to keep your truck running and reduce expenditures simultaneously.

- Generates Additional Income – Besides the reduction of cost, leasing your truck to another company provides a steady passive income stream. In other words, you don’t have to rely solely on transporting cargo to generate income. With a steady income flow, you can improve your finances and invest in other ventures or drive using a secondary truck.

- Allows You to Take a Long Break – Most owner-operators struggle to maintain a healthy work-life balance, especially when hauling cargo across vast distances. Leasing trucks removes some of the burden and allows truckers to take longer breaks while still generating sufficient income for daily expenses.

- Circumvents Low Periods – Individuals and companies in the trucking industry occasionally experience low-demand periods depending on the industries their business is involved in, affecting profitability. To mitigate this risk, many owner-operators lease their trucks during such periods to maintain a positive cash flow. Trucking companies with large fleets also leverage the leasing strategy when they don’t have sufficient loads to use all their trucks.

Potential Drawbacks of Leasing Your Truck to a Company

Semi-truck leasing isn’t without a few drawbacks. We’ll take a closer look at some of the disadvantages below.

- Abrupt Contract Terminations – Although semi-truck leasing provides truckers with a stable income source, it also makes them vulnerable to abrupt contract termination. Lessees, such as trucking companies or other owner-operators, can decide they no longer require the truck, prompting them to prematurely terminate their lease contract. Although most contracts include an early termination fee, this can still be a hassle for lessors. It disrupts their income stream and forces them the hassle of retrieving and inspecting their trucks in addition to looking for new leasing opportunities.

- Repair & Maintenance Arrangements – Many companies may be interested in leasing your truck but do not want to manage repairs or maintenance. Although you receive a higher compensation with this leasing arrangement, you take on more administrative tasks. It also makes you accountable for delays or disruptions since you’re responsible for ensuring the truck is in good condition.

- Limited Control Over Asset – Leasing your truck to a third party takes away control over your asset until the contract is terminated. Even if your business picks up, you cannot use the truck to haul cargo for your clients unless you wait for the lease term to end or break the contract prematurely, incurring a compensation fee.

- Depreciation of Semi-Truck Value – Leasing your truck to a third party increases its utilization rate. However, it also increases its mileage, wear and tear, and damage potential, accelerating depreciation and reducing its resale value. Some trucking companies may also practice slip seating to enable round-the-clock operations, further reducing its value.

Tips & Best Practices

When leasing trucks, you should consider the benefits and drawbacks to prevent losses and dissatisfaction. Below are some tips and best practices to ensure a positive outcome.

Have a Comprehensive Lease Agreement

When leasing a truck, the best way to protect yourself is to create a formal lease agreement outlining all terms and conditions. By diligently covering all necessary aspects of the process, you can prevent disputes. When drafting the agreement, address key aspects of the terms and conditions including:

- Lease Duration

- Payment Terms

- Responsibilities of Each Party

- Dispute Resolutions

You can also include optional clauses to cover interest on late payments and penalties or additional fees for exceeding mileage limitations. Engage a legal professional if you are unsure.

Create an Extensive Checklist

Before leasing your truck, take photographs and videos of your truck to use as evidence in damage disputes. Make a detailed checklist outlining mileage, fuel level, scratches, tire brands, engine condition, and paintwork.

Then, ensure the lessee acknowledges and signs the list. By doing so, they accept that the truck was given to them in a certain condition and are responsible for any damages or issues that arise thereafter.

Ensure That Your Truck Is Insured

It can be easy to neglect the renewal of insurance once your truck is out of your hands. Trucking insurance is the best tool to safeguard your assets from damage. In most jurisdictions, operating a heavy-duty vehicle without insurance is illegal.

Keep a record in your calendar for the expiration of your vehicle’s insurance and ensure that you renew it diligently. However, having insurance is just a prerequisite. You must also learn how insurance claims are handled and take proactive steps to maximize financial protection for your vehicle.

Account for Maintenance and Repairs

Proactively determine who is responsible for maintenance and repairs in the lease agreement by outlining it in terms and conditions. This will prevent misalignments and improve satisfaction on both ends.

Keep a current maintenance record and share it with the lessee if you’re responsible for maintaining the truck’s condition. In your agreement, include provisions for regular inspections and prompt the lessee to address any issues without delay. You can also provide a manual or guide for handling breakdowns or emergency repairs.

Seek Legal Advice If Required

You should speak to a legal advisor or lawyer specializing in leases who has experience in the trucking industry. They can help in drafting leasing contracts, handle insurance claims, and manage the legal aspects of owning and leasing trucks. Doing so will reduce the risk of loss, damages, fraud, and other common issues truckers face due to limited legal expertise.

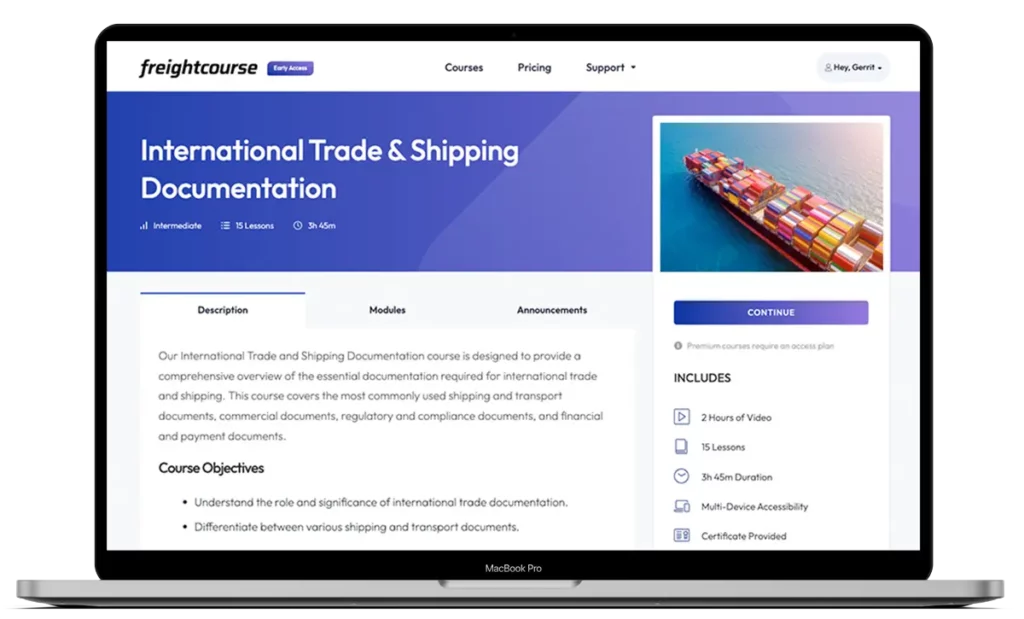

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us