As modern supply chain processes are constantly evolving, so do the individual components of it. Over time, many different payment terms have been introduced. One of the relatively common payment terms is known as ‘after receipt of order’.

After receipt of order (ARO) in shipping is a payment term that indicates how many days the payment is due, after the seller has received the order. For example, a payment could be due 15 days after the buyer has placed an order for the items, if an ARO term was agreed between the buyer and seller.

In general, a payment term is part of the terms and conditions that indicate a specified time for settlement. It’s reasonable to assume that a buyer and seller (shipper and consignee), would benefit from a fair payment arrangement. Therefore, it’s common for them to negotiate on the type of payment terms.

This article will help you understand the concept of payment terms, with a special focus on ARO. We’ll be going through some of the similarities and differences between ARO and other payment terms to help you understand the concept more clearly.

How to Understand After Receipt of Order (ARO)?

In typical long term business engagement between the buyer and seller, once an order has been received, the shipping process can proceed. It’s common for both parties to agree on a payment term, whereby the buyer receives the goods or services and pays within the agreement payment window.

There are several payment terms a contract or purchase agreement can have. Here is an example of a purchase order with a payment term “ARO 7 Days”. In this instance, the payment window given by the seller is 7 days.

This means that the buyer has a duty to complete the payment within 7 days after receipt of order (ARO), meaning after the seller has received the order. This can even happen before the actual shipping date.

| Invoice Number | 108619 |

| Invoice Date | March 1, 2021 |

| Shipping Date | March 9, 2021 |

| Payment Term | ARO 7 Days |

As an ARO payment term can require the payment to happen before the actual shipment of goods, and also vice versa, the ARO payment term is recommended for buyers and sellers who have a long-standing business relationship.

Advantages and Disadvantages of After Receipt of Order (ARO)

As ARO is one of many different payment terms, it has several advantages and disadvantages that should be considered. Whether you should consider using an ARO payment term depends on your business relationship with your buyer or seller, and the cash flow situation of your business.

| Advantages | Disadvantages | |

| Profile | Works best for partners with long-term relationships Most suitable when the supplier is trustworthy Can be considered if the buyer has established a stable track record of payment settlement. | Not suitable for single purchases or first-time orders Should not be considered if buyer typically doesn’t pay on time or shipper doesn’t ship on time |

| Payment | Payment can be expected within the agreed ARO timeframe. Payment can be received almost immediately without shipment arriving at the destination. | Has no relation to the shipment date Shipping window can be before or after ARO date |

| Cash Flow Management | Managing cash flow is easier because buyers pay within the agreed term, after order placement. | Can hamper cash flow if ARO payment window is too wide |

| Order | Order may be shipped to the buyer before payment settlement | Supplier may need to fulfil the order before receiving payment |

| Bill of Lading (Sea Freight) | Can hold Bill of Lading until goods are fully paid. | If BL is already telex released or surrendered, cargo will be released at destination. |

Considering the above, it can be said that until the payment is received, the risk lies with the seller. This is because they have to start the fulfilment process before receiving the payment. The risk of the buyer is the window between payment and shipping date (and is some cases until cargo arrival date).

Is After Receipt of Order (ARO) indicated in Calendar or Business Days?

ARO payment terms are most commonly indicated in calendar days. For example if the payment term is “ARO 7 Days”, the buyer should complete the payment within 7 calendar days of placing the order.

ARO vs ARP

The payment term ARO shouldn’t be confused with After Receipt of Payment (ARP). An ARP payment term stipulates that the supplier only ships the goods after they have received the payment.

This means that the shipper will not initiate the shipment process until the payment has been made. On some occasions, some suppliers will indicate the amount of days they will ship the goods, once the payment has been received.

| Invoice Number | 108620 |

| Invoice Date | March 1, 2021 |

| Payment Term | ARP 3 Days |

An ARO arrangement exposes the shipper to less risk, as they are securing the payment before fulfilling the order.

ARO vs Net Payment

Buyers and sellers have different payment requirements and a net payment term is one of the most popular credit terms. A net payment indicates the amount of days a payment is due from the invoice date, whereby the ARO uses the received order date.

Invoices are generally dated after a service is performed or an order has been placed. These dates can even be after sailing, flight departure or courier delivery, depending on the arrangement.

| Invoice Number | 108621 |

| Invoice Date | March 1, 2021 |

| Invoice Due Date | March 31, 2021 |

| Payment Term | NET 30 Days |

In this example the invoice date is March 1, 2021, whereby the payment is due in 30 days, which would fall on March 31, 2021. It can also be written as Net 30 days or simply Net 30.

ARO vs COD

Cash on delivery is a payment term that heavily favors the buyer, as they only release the payment in cash when a consignment is delivered. This type of payment arrangement is more popular in e-commerce scenarios, as there is an intermediary (typically the online marketplace) that validates the payment information from the buyer.

| Invoice Number | 108622 |

| Invoice Date | March 1, 2021 |

| Payment Term | Cash on Delivery |

In summary, cash on delivery terms favor the buyer and the payment is only released upon receipt of cargo, whereas an ARO payment term would require an upfront payment from the buyer after an order has been placed.

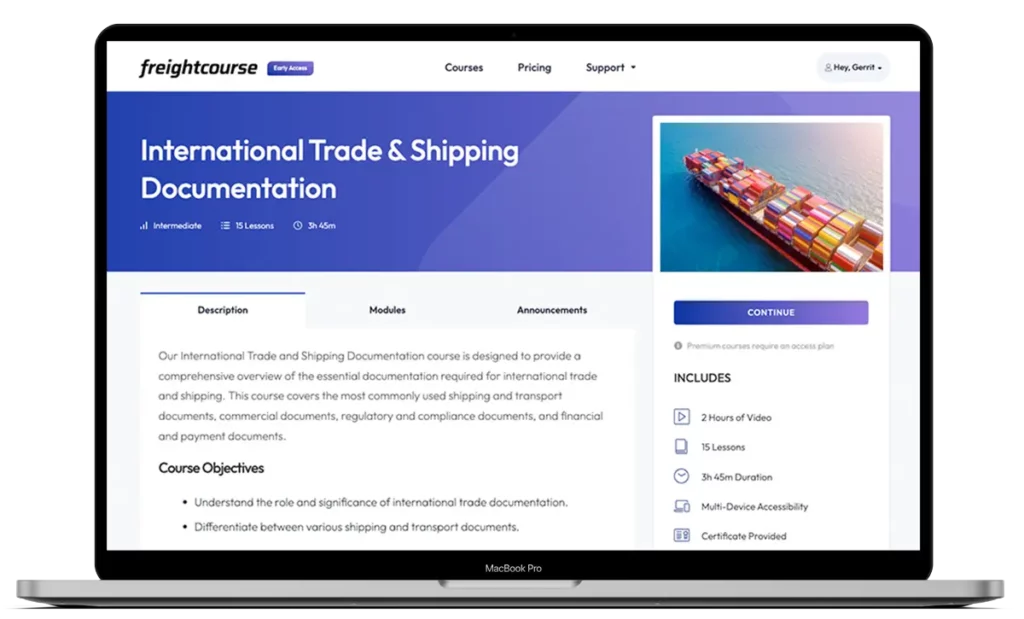

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us