Most savvy importers and exporters are familiar with various types of payment terms, such as Open Account, Documentary Collection, Cash Against Documents, and Documents Against Acceptance.

These terms are a crucial aspect of International Trade as exporters and importers (or buyers and sellers) use them to determine how the final payment for incoming and outgoing cargo is to be processed.

More importantly, they’re designed to reduce the risk involved in the recovery of invoice amounts following disputes or other issues that lead to non-payment.

Documents Against Acceptance (abbreviated as D/A, or DA) is an agreement in which the exporter (seller) issues a bill of exchange to the importer (buyer). Upon acceptance of the bill, the buyer is able to obtain the shipping documents and is required to pay the invoices before a predetermined date.

DA agreements are typically processed through remitting bank (in the exporting country) and the collecting bank (in the importing country). With this payment term, importers require a bank clearance to receive and take possession of goods when their shipment arrives.

However, there’s a lot more to DA payments for importers and exporters to understand. In this post, we’ll explain how the Document Against Acceptance arrangements are used, its benefits and risks, and the process flow.

We will also share detailed comparisons between DA payments and other payment terms in the industry.

When Are Documents Against Acceptance Payments Used?

The purpose of Documents Against Acceptance payments is so the buyer is able to collect the shipping documents and therefore the cargo when the bill of exchange is accepted.

Therefore, DA payments are more favorable toward buyers as they are granted access to and ownership of the shipment without having to pay for the commercial bill at the time of agreement.

However, the bill of exchange will stipulate a maturity date, before which the buyer is required to settle the outstanding. If they fail to make payment before the maturity date, the seller has limited recourse.

Therefore, this payment term is often used among parties with long-standing relationships. Others using DA payments often combine them with other payment terms to mitigate some of the risks.

Many sellers also use DA payments as a value proposition, especially on large orders and shipments with trusted customers. By allowing buyers more time to pay for the goods (meaning better cash flow), they can secure better deals with them and also entice them to make repeated purchases.

Furthermore, DA payments are also commonly used for small-quantity shipments, especially during initial transactions. For instance, many buyers purchase small quantities of goods to use as commercial samples and test their performance in their respective markets before placing larger orders within the time draft’s timeframe.

Benefits of Documents Against Acceptance

Although DA payment terms seem to be more favorable for buyers, both parties can enjoy a wide range of benefits by opting for an agreement like this. Let’s explore them in more detail.

For Buyers

As mentioned, DA payment terms favor the buyer. We have listed some of the most impactful benefits below:

- Better Cash Flow – The most obvious benefit of DA terms is the delay of invoice payments. By opting for this payment term, buyers don’t have to pay for goods immediately. Instead, the buyer and seller agree on a maturity date that will be indicated on the bill of exchange.

- Reduced Liabilities – In many cases, buyers incur losses by receiving damaged or wrong goods. Moreover, they may have to go through tedious discussions and renegotiations with sellers to resolve the dispute. Unfortunately, since they’ve already paid for the shipment, they’re liable for any damages. However, by opting for DA payments, buyers have the option to check and reject goods before settling the outstanding amount.

- Bank Manages Payment – From a legal perspective, the biggest benefit DA payments provide is the involvement of a local bank to ensure a safe transaction (a remitting back at the origin and a collecting bank at the destination). With a third-party financial entity on board, both parties can mitigate some of the risks associated with import and export transactions.

For Seller

While most benefits are indirect for sellers or exporters, there are perks that would motivate them to offer DA payment terms to their customers.

- Competitive Terms – Since many sellers impose mutually-beneficial payment terms, they are able to entice customers through DA payments to negotiate and secure larger orders.

- Improves Business Relationships – Although DA payments make sellers vulnerable to delayed or defaulted payments, they’re powerful facilities for building positive, long-term relationships with buyers as it showcases mutual trust.

- Secured Transactions – Since DA transactions are done through banks, sellers don’t have to worry about suspicious activities or transaction issues as the contract legally obligates buyers to pay for shipments as per the time draft terms and the terms stipulated in the bill of exchange.

Risks of Documents Against Acceptance

Although DA payments offer different benefits for buyers and sellers, they carry different risks for both parties that could affect their cash flow or relationships.

For Buyer

Buyers would still need to understand the risks listed below instead of eagerly accepting DA terms.

- Higher Costs – The biggest risk buyers face when opting for DA payment is higher markups. Since sellers are prepared to take risks, a higher payment is often the reward they seek for the time leverage they grant and the early handover of shipment documents.

- Duration For Dispute Resolution – Once buyers receive a time draft from their bank, they’re legally obligated to pay for the shipment within a specified period. However, this can lead to potential issues, especially if buyers and sellers have disputes related to the shipment. Since payments need to be done within the stipulated timeframe, buyers have a short window (if any) to resolve the dispute.

- Longer Processing Time – Document Against Acceptance transactions take more time and are more tedious than most payment terms (with the exception of Letter of Credit transactions). A longer processing time could disrupt the workflow of buyers and lead to several consequential issues, such as delayed deliveries.

For Seller

The risks for DA payments fall mainly on the sellers. Below are some of the more important risks sellers should take note of:

- Uncertainty of Payment – The biggest risk sellers face when opting for DA payment terms is that they surrender the shipping documents and control of the cargo upon the buyer accepting the bill of exchange (typically even before the payment is completed). From goods being rejected to disputes and banking issues, sellers often have to incur damages due to delayed or defaulted payments for issues that are not their fault. This also means that the buyer may eventually not be able to or is unwilling to pay.

- Payment Collection – Another risk sellers have to deal with when opting for DA payments is the wait time, which is typically 30, 60, or 90 days. Depending on the cost and amount of shipment, the wait time could be longer. For many sellers, this waiting period (which is stipulated in the bill of exchange) could affect their workflow or limit their working capital for other shipments or order fulfillment.

- Rejected Stock – Another major risk for sellers associated with this payment term is rejected stock. Since buyers can legally check and reject shipments, sellers either have to incur losses to ship back the goods or auction them off at a lower price.

Process for Shipments With DA Payment Terms

Shipping cargo using Documents Against Acceptance payments is relatively simple. Below is a brief overview of the process:

- A typical shipping process begins with negotiations between importers and exporters related to the cost of goods, freight transport, and other relevant expenses (warehousing, security, lead time, and more). By mutually agreeing to use DA payment terms, both parties also decide the payment term, which is typically anywhere between 30-90 days.

- After confirming and signing the agreement, the seller engages their bank (remitting bank) to determine what documents are required, such as a Bill of Lading (B/L), Bill of Exchange (BOE), commercial invoice, packing list, etc.

- Once the goods are shipped, the seller receives a Bill of Lading (B/L) from the freight forwarder and sends it to the bank along with other necessary documents. These documents would then be sent to the buyer’s bank (collecting bank).

- Upon receiving the documents, the bank will notify the buyer to sign the BOE and release the relevant documents to them. The signed BOE would be sent to the seller’s bank while the seller awaits payment from the buyer.

- Once the BOE is accepted, the buyer is able to collect the shipping documents and the cargo. The payment is due upon the agreed maturity date on the bill of exchange.

Tips for Buyers and Sellers Using Documents Against Acceptance

Using the Documents Against Acceptance payment terms requires a proper mix of research, strategy, and effective communication. Below are a few tips buyers and sellers can use to simplify the process and reap the full benefits of DA payments.

- Offer to Long-Standing Clients – Sellers are highly recommended to opt for DA payments with buyers only if they have an excellent payment record or relationship with them. Doing so will reduce the chances of disputes, goods rejection, and payment issues significantly.

- Use for Low-Value Shipments – Another great tip for sellers is to opt for small or low-value shipments, such as commercial samples or export overproduction. Doing so will help minimize some of the financial loss if a buyer rejects the goods or fails to pay. Moreover, low-value shipments can also be used to build good relationships with prospectus buyers. Sellers can use them to test buyers and determine if they can be trusted with high-value shipments in the future.

- Set Clear Expectations – When using DA payment terms, both parties should specify all relevant details related to the transaction, such as goods quantity, quality, additional fees, lead time, prices, and dispute resolution. Doing so will drastically reduce the rejection rates of buyers upon receiving the goods.

- Do Due Diligence – If both parties are doing business with each other for the first time, it is vital to do due diligence such as credit checks, product reviews, company reputation, and other details before agreeing to DA payment terms. Proactive due diligence is a smart way to prevent any issues or losses.

- Select Reputable Banks – Since banks play a vital role in the transaction, both parties must choose a reputable one with up-to-date financial technologies and practices, along with a capable support team with experience in import and export transactions. Doing so can result in faster and hassle-free admin processes and improve the overall experience for both parties.

- Consider Hybrid Payment Terms – Finally, we recommend opting for combined payment terms, such as Open Account (O/A) + Documents Against Acceptance (DA). Doing so will reduce the risk on both parties’ parts and help ensure both parties maintain a good cash flow.

Payment Terms Comparison

As mentioned earlier, Documents Against Acceptance is just one of the many payment terms exporters and importers can opt for when buying and selling goods internationally.

In the section below, we will be comparing the most common payment terms with DA payments to understand the key differences in terms of process, cost, and which party it favors.

Documents Against Acceptance (DA) vs Documents Against Payment (DP)

The key difference between Documents Against Acceptance (DA) and Documents Against Payment (DP) terms are that DP requires buyers to pay for the shipment first before their bank surrenders the shipping documents to them.

Both terms have similar payment terms and processes. The main difference is the time in which the seller receives the payment. Overall, the DP terms don’t favor any particular party. Instead, it balances the risk in a way both parties have an equal amount of control.

For instance, sellers can reduce the risk of non-payment by ensuring the bank holds the documents as collateral until the buyer pays for the goods. At the same time, buyers can still reject the goods and raise disputes.

Documents Against Acceptance (DA) vs Letter of Credit (LC)

A Letter of Credit (L/C) is one of the most common and safest international trade mechanisms in the industry. It legally requires a buyer to give a written commitment to the seller as an assurance for payment settlement as per the agreed timeline and terms & conditions.

While both DA and L/C arrangements have documents processed through both banks, they have one fundamental difference. The key difference is that when using a Letter of Credit, the bank guarantees payment to the shipper or exporter if their obligations have been fulfilled.

Overall, a Letter of Credit (L/C) payment favors the seller, as they are guaranteed payment as long as they ship the cargo and issue the necessary shipping documents.

Documents Against Acceptance vs Open Account

Open Account payments involve sellers shipping goods to buyers and receiving payment at the end of an agreed-upon credit period. However, unlike DA payments, financial institutes are not involved in document and transaction facilitation.

The Open Account payment term is typically sought out by importers and exporters with high volumes of goods exchanged. It entails creating a contract signed by both parties to receive goods via shipment and payment via bank wire transfer.

Since the relationship relies heavily on trust between the two parties, Open Accounts tend to favor buyers or importers more, as the goods are shipped before payment (similar to DA payments).

Similarly, buyers can reject shipments or fail to pay for them for various reasons, putting the seller’s cash flow and capital at risk since they have already manufactured, shipped, or distributed the goods.

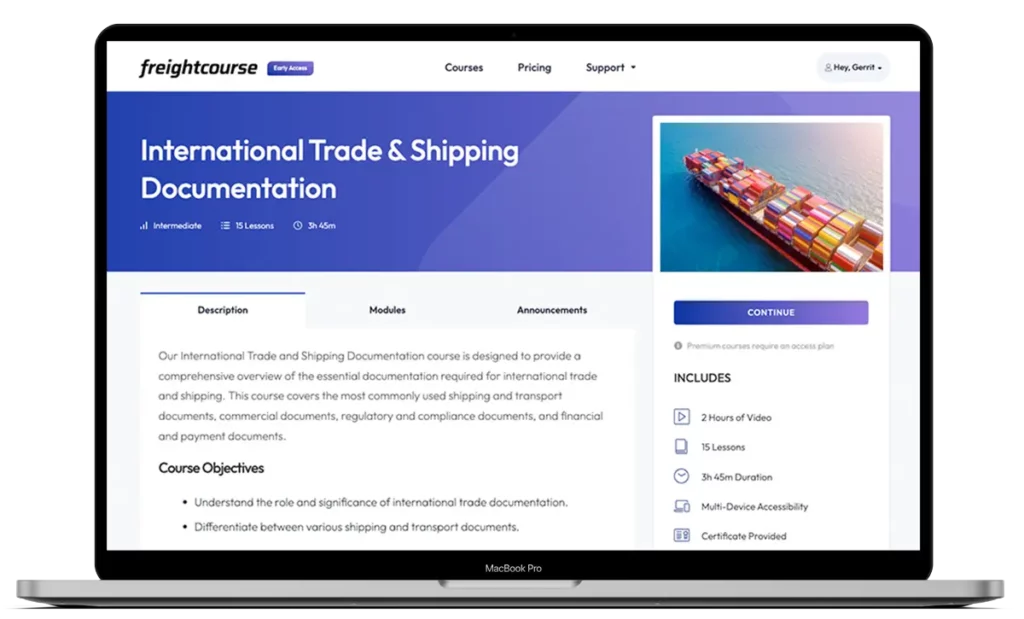

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us