The rapid influx of new and advanced technologies in the transportation industry is increasing competition for trucking businesses and owner-operators. Truckers leverage many solutions to improve operational efficiency and profitability.

These solutions include GPS tracking, digitalized fleet management, dynamic routing, real-time surveillance, and transit data recording. Most of these solutions enable users to leverage big data and enable data analytics to measure performance, safety, financial, environmental, and other key metrics.

Truckers can use this information to develop strategies for evaluating and improving operations. The industry defines this crucial process as fleet benchmarking and depends heavily on it to make necessary adjustments.

In this article, we’ll explain fleet benchmarking in detail and share the key data points truckers use when evaluating performance. We’ll also explore the different benchmarking methodologies used by trucking businesses and talk about the opportunities and limitations of fleet benchmarking.

What Is Fleet Benchmarking in the Trucking Industry?

Fleet benchmarking is the strategy or processes trucking companies use to gauge service quality and performance using data collected from electronic logging devices (ELDs), fleet management software, and other solutions integrated at different touchpoints of their value chain.

Without fleet benchmarking, trucking companies, owner-operators, and fleet managers have little or no effective ways to identify, understand, and resolve issues that increase expenditures, disruptions, and client dissatisfaction.

Today, most truckers operate in an economically-constrained business environment with record fuel prices, more taxes, and higher repair and maintenance costs. As a result, establishing data sets to measure performance and comparing them with industry standards is no longer a choice but a necessity.

Fleet benchmarking can identify areas of improvement, such as reducing idling, increasing truck utilization, enforcing maintenance schedules, and more effective route management. It can help you understand and monitor performance by setting a point of reference based on historical or competitor performance figures.

Common Fleet Benchmarking Data Points

As mentioned earlier, fleet benchmarking involves using various data points that allow fleet managers to generate valuable insights. Below are some of the main data points that are commonly used.

- Fuel Consumption – Fuel is among the biggest recurring expenses truckers bear when hauling cargo. Therefore, fuel economy and consumption are crucial metrics that can help lower the overall cost per mile by evaluating routes and driving practices (idling, bobtailing, etc.).

- Driver Performance – Thanks to ELDs, trucking companies can now measure driver performance using data points, such as idling, out-of-route miles, speeding, HOS compliance, and the number/duration of stops during trips.

- Schedule and Route Efficiency – Trucking companies use route planning systems to create delivery schedules based on several factors, including distance, number/type of vehicles, number of deliveries, etc. They can make necessary adjustments by measuring schedule and route efficiency, such as choosing shorter routes or assessing road conditions before initiating the transit process.

- Cost Per Mile – Understanding the cost per mile is perhaps the most important metric for truckers. It measures how much money each mile on the road transporting cargo for clients costs them. By tracking the cost per mile, they can calculate their operational efficiency and set their freight rates. They can also devise different strategies and adopt other practices to reduce their cost per mile, such as leveraging drop yards or purchasing auxiliary power units (APUs) to reduce fuel consumption.

- Truck Expenses – Keeping tabs on trucking expenses, such as fuel, truck payments, taxes, maintenance, and drop yard rental allows trucking companies to set and manage their operating capital accordingly.

- Truck Utilization – Truck utilization is the measure of actual performance compared to the optimal or required performance. It refers to how well trucks meet supply and demand by considering factors, such as idling, downtime, maintenance, dead miles, and more.

- Environmental Ratings – Collecting emissions data is essential for truckers since they have to adhere to EPA standards and control the release of harmful pollutants to the environment. Customers with sustainability programs are also inclined to work with companies that operate trucks with lower emissions.

- Safety Ratings – Data related to hours of service (HOS), accidents, hard braking, and road conditions can have truckers measure and improve safety when hauling cargo.

Benchmarking Methodologies

Fleet benchmarking is only possible when truckers have sufficient data they can leverage to measure different aspects of performance. Below are the steps for its application:

- Setting up a measurement infrastructure for key data points

- Obtaining actual data from day-to-day operations

- Sorting and analyzing data sets

- Comparing actual data sets to a reference data set

- Implementing improvement projects

- Monitoring data points to verify results

We will discuss the two main methods for obtaining reference data sets below:

Industry Experts

One of the most reliable ways to obtain reference data for fleet benchmarking is through industry experts. This includes:

- Consultants with broad expertise or experience within the industry

- Trucking associations

- Fleet benchmarking software providers who have done extensive market research and have the ability to share best practices and industry benchmarks

These groups have the expertise and experience in their respective domains to offer accurate information for analytics. As a fleet manager or owner-operator, you need to obtain as much reference data as possible and take the average to account for variances so you can devise different strategies that help you reach or exceed the industry standard.

It is vital to ensure that the data set that you obtain is relevant to your business model. Some key aspects to take note of when evaluating the relevance of a data set is the location, fleet size, timeframe, typical routes, vehicle type & age, and cargo type.

Past Data

Many trucking companies, especially larger ones, leverage historical data from their business for current and future fleet benchmarking. However, this method is not designed to determine whether a trucking company performs according to industry standards.

Instead, it’s used to identify any potential improvements that can be made to increase operational efficiency. Past data allows users to obtain a reference data set unique to their operations.

Moreover, it makes data collection easier and more consistent since most information will be extracted from solutions used by the company. When choosing the best method for your trucking business, using data sets from industry experts may benefit market followers.

On the other hand, past data would prove to be more relevant for market leaders or businesses with a more innovative approach. Nevertheless, we recommend using data from industry experts in conjunction with historical data sets for the best results.

Opportunities for Fleet Benchmarking

Fleet benchmarking offers several lucrative opportunities truckers can use to simplify operations, save money, increase loads, and unlock many other benefits, which we will delve into in this section.

Shows Financial & Operational Performance

Fleet benchmarking uses several metrics and data points, such as cost per mile, trucking expenses, and driver performance, to show financial and operational performance.

From a business viewpoint, access to performance information can help trucking companies determine where they stand and set new financial and efficiency goals.

Highlights Areas For Improvement

Data points help identify several areas that need improvement. For example, idling reports can enable trucking companies to devise stricter policies for drivers to follow and reduce the practice.

Depending on their level of operations, they could also equip their fleet with APUs to reduce fuel consumption.

Can Reduce Operating Costs

Fleet benchmarking can identify the most inefficient areas of operations and prompt users to develop strategies or employ new practices to reduce operating costs. For instance, downtime statistics can be used to create new repair and preventive maintenance schedules.

Maximizes Fleet Utilization

Finally, fleet benchmarking can help trucking companies understand which trucks are underutilized. With this information, they can assign loads and drivers to increase utilization, monitor income per truck, and employ new practices to improve it.

For instance, they can start drop-trailer programs or introduce slip seating practices to increase the number of deliveries made in a single day.

Limitations of Fleet Benchmarking

Unfortunately, fleet benchmarking is not without a few limitations. Let’s explore these in more detail below.

Data Dependency

As mentioned earlier, proactive data collection is essential for leveraging fleet benchmarking into your information. Moreover, data quality is just as important. The last thing any trucking company wants is to use inaccurate data, leading to disruptions, downtime, and financial losses.

Requires Analysis & Benchmarking

Benchmark numbers need to be organized and set in a specific order to relate to the data collected and analyzed by different methodologies. Hence, it can easily become a daunting and cumbersome task that may require hiring an industry professional or a third-party service.

Requires Consistent Monitoring

Consistent monitoring is one of the most important aspects of data analytics. As the trucking industry becomes more fluid, data variances are more frequent than ever before.

Therefore, progress can only be measured if data gathering and monitoring are done more frequently, so users can access the latest insights for evaluation and re-evaluation.

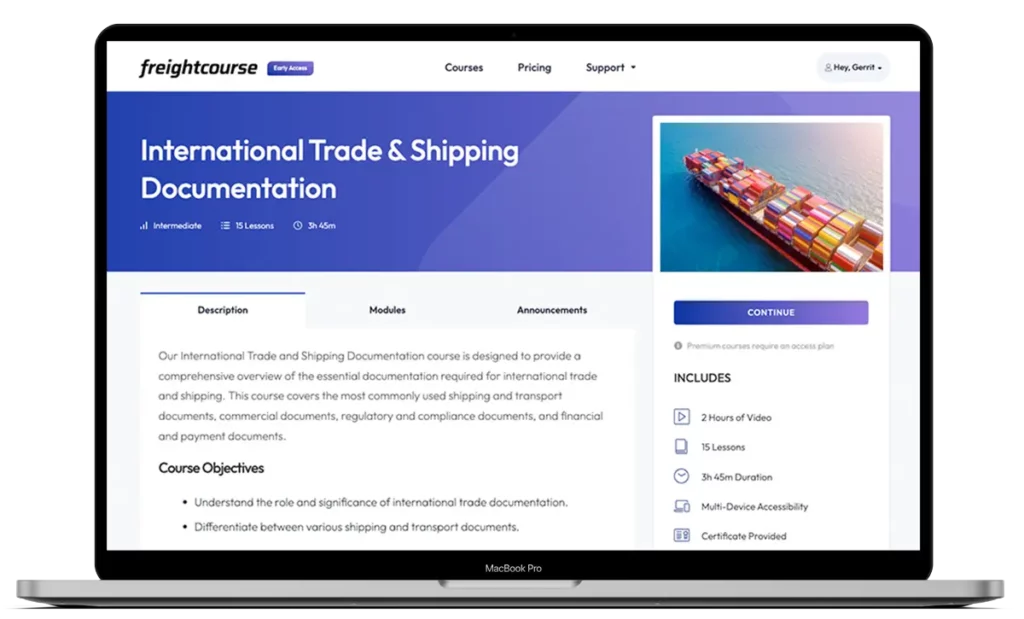

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Andrew Lin

Co-Founder & Writer

at freightcourse

About the Author

Andrew is a multi-business owner with over 12 years of experience in the fields of logistics, trucking, manufacturing, operations, training, and education.

Being the co-founder of freightcourse has given him the ability to pursue his desire to educate others on manufacturing and supply chain topics.

Follow us