Freight brokers hold an important role within the global supply chain and logistics industry as they act as intermediaries between carriers, shippers, brokers, agencies, and consignees.

Their profit model revolves around a framework of buying services, such as sea and air freight, trucking, and customs brokers, among various others from underlying service providers, and selling them to their customers for a higher fee.

In other words, they take a cut or commission by outsourcing the service to a third-party service provider. While this represents a large portion of their income stream, they also generate revenue through offering value-added services, such as documentation, shipment tracking, and more.

In this article, we’ll explain in detail how freight brokers generate revenue, how they get paid, and their key financial metrics. We will also dedicate a section to explain the different ways freight brokers can increase their revenue and maximize their profit margins.

The Role of Freight Brokers in the Logistics Industry

Before we explore how freight brokers generate revenue, it’s important to first understand the role they play in the logistics industry. Whether hauling cargo or shipping goods, there are various parties and touchpoints involved in the shipping process.

Shippers and consignees may not always have the time or resources to maintain prompt scheduling as demand, operational requirements, and shipment needs grow. Similarly, carriers may not always have consistent access to freight.

For certain shipping profiles, working with freight brokers often allows for more flexibility, better customer service, and a more comprehensive service offering. In essence, shippers can work with one service provider, instead of having to liaise with multiple parties to move their cargo.

Shippers with larger shipping volumes sometimes prefer a single point of contact. Working with a freight broker minimizes the need to establish several communication channels and manage information exchange with just one line.

More importantly, working with a broker enables shippers and consignees to forgo the need to participate in carrier negotiations, route planning, cargo tracking, and other non-core activities.

Freight brokers can leverage their expertise to optimize sailings, trucking routes, delivery times, and maximize supply chain efficiency. This allows shippers and consignees to allocate their resources and labor to fulfill their core competencies.

How Freight Brokers Generate Revenue

Freight brokers make money by charging their customers (shippers and consignees) a fee for their service that is higher than their buying rate of these services (from carriers, customs brokers, trucking companies, and similar service providers).

Example A shipper hires a freight broker to move their shipment across the state via reefer trucks. The broker quotes them a price of $3,400 ($3,000 for the transportation, $150 for the documentation, and $250 lumper services). After the shippers agrees on the quotation, the broker outsources the shipment to one of their partnered carriers for $2,400, which includes the lumper fees). The documentation is insourced. Calculation Total Revenue: $3,400 Cost of Services: $2,400 Total Profit: $1,000

There are also other types of services that shippers require, where freight brokers can add value. Let’s take a closer look.

- Sea Freight – Freight brokers facilitate the process of transporting large amounts of cargo using container vessels by connecting shipping lines with shippers. Often, freight brokers act as carriers.

- Air Freight – They also enable shippers to expedite the transportation of their cargo to their destination via an air carrier. While they may outsource this to an airline directly, freight brokers typically ease the process of coordinating with the airline.

- Trucking – Freight brokers also work with shippers looking to move cargo using different types of trucks. They facilitate the communications between them and carriers or truck dispatchers and provide key services, including shipment booking, reporting, accounting, and tracking.

- Customs Clearance – Customs clearance services ensure that goods being imported or exported comply with all necessary regulations and also have the required documentation.

- Documentation – Many freight brokers offer documentation services such as import and export forms, as well as certificate and permit applications, among many others.

- Factoring – Factoring is a brokerage service offered mostly to trucking carriers looking to receive faster payments for their services. Here, freight brokers work with factoring companies to accelerate payment processing and collection in exchange for a small percentage of the payment.

- Additional Services – Additional freight brokerage services include cargo inspection, packaging, fumigation, and consultation, to name a few.

Financial Metrics of Freight Brokers

The core concept of brokerage services is to procure freight services at certain rates and sell them at higher rates. This section will break down and help you understand the key financial metrics involved.

Gross Revenue

Gross revenue, in the context of freight brokerage services, is the sum of all money generated by brokers without accounting for expenses, profits, or losses. Aside from freight transportation, freight brokers also generate gross revenue from various other services rendered, including freight bookings, accounting, inspection, and more.

Gross Profit

In simple terms, gross profit is the difference between the cost of outsourcing freight services to carriers or other third parties and the sell rates to shippers or consignees. It does not take interest, taxes, depreciation, and amortization into account.

Gross profit also serves as the capital brokers use to pay for day-to-day operations. Let’s take an example to explain this further:

Example

A broker partners with a shipping line to move freight at $500 per container. A shipper requests a quote for moving 10 containers from the freight broker. The broker quotes them a price of $560 per container.

In this case, the broker receives a $60 gross profit per container. Therefore, their total gross profit for shipping 10 containers is $600.

Operating Profit

Once brokers calculate the gross profit, they can calculate the operating profit by accounting for all other costs associated with the business, along with depreciation and amortization. Examples of operating expenses include rent, staff salaries, freight software subscription services, utility bills, and third-party services, to name a few.

EBIT/EBITDA

EBITDA is an acronym for earnings before interest, taxes, depreciation, and amortization. Many businesses cover depreciation and amortization in their operating profit. In this case, the term is simply EBIT.

Both EBIT and EBITDA are among the most popular metrics freight brokers use to measure their firm’s financial health and ability to generate free cash flow. In layman’s terms, EBITDA is the net profit brokers earn before interest, taxes, depreciation, and amortization, respectively.

Net Profit

Finally, the last metric that brokers use is net profit, also known as the bottom line. It is the difference between the total gross revenue and all the expenses, taxes, and other deductions incurred by the business during a fiscal period. In short, it’s what brokers make for the various services rendered.

Freight Broker Payment Terms

Freight brokers employ a unique payment model that caters to carriers, shippers, and third-party service providers they work with. As intermediaries, they have to pay carriers for transporting cargo and also collect payment from shippers.

However, due to the different credit terms, brokers have to be strategic. For instance, shippers typically operate on net-30, net-60, or even net-90 meaning they pay brokers for the shipment within 30, 60, or 90 days, respectively.

In contrast, carriers usually expect brokers to pay them for their services immediately or within 7 or 30 days, depending on their capital and business agreements with the underlying service providers.

Does Engaging a Freight Broker Cost More?

Working with a freight broker provides shippers and carriers access to several services at a cost. The charges depend on several factors, including service type, branding, location, and complexity of job scope, among others.

However, this doesn’t mean working with a broker will always cost shippers more than engaging a carrier directly. Freight brokers are experts in the air, sea, rail, and truck freight industry.

Hence, they have the experiences and resources to navigate highly competitive price structures by matching supply and demand between all parties. Moreover, they partner with several carriers to offer a more cost-efficient structure for specific routes.

Most shippers or consignees don’t have the expertise, resources, or network to get the same or lower rates for their loads. Moreover, freight brokers can typically consolidate larger volumes of cargo than any individual shipper and obtain more favorable rates from carriers.

How Freight Brokers Maximize Their Profit Margins

Freight brokers only get paid the difference between what they charge shippers or consignees and what they pay carriers. Therefore, they employ different strategies to increase their margins and maximize their earnings after cutting all expenses.

Capitalizing on Technology

Forward-thinking freight brokers invest in the latest technologies in the market and integrate them at different touchpoints within their value chain to improve their cost efficiency.

Below are some of the most common tools, software, and solutions that freight brokers use to improve their service offerings, improve their operational efficiency, and lower expenditures.

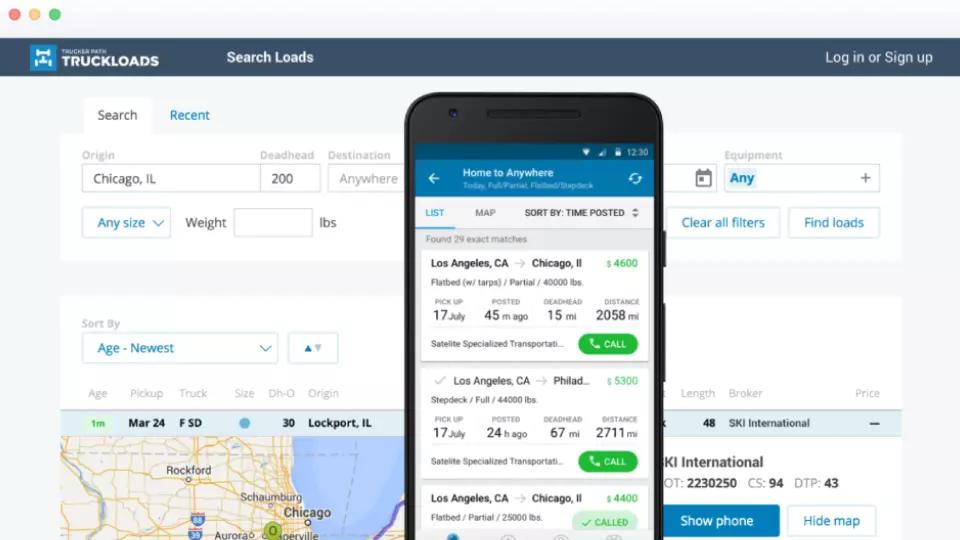

- Load boards – Brokers can use load boards to compare market rates while expanding their network of shippers and carriers.

- Digital Freight Matching Platforms – Advanced platforms like digital freight matching solutions not only allow users to compare rates but also predict market trends and optimize routes using machine learning and AI.

- Transport Management Systems – One of the most essential tools in the industry is a transport management system. This enables logistic companies to manage their resources and timelines to improve productivity and efficiency.

Not every shipper would have the capabilities or resources to integrate these solutions into their operations, especially if they don’t have a demand for them (considering the cost of investment). Hence, they simply work with brokers to leverage their solutions for a small price.

Leveraging Their Extensive Network

Freight brokers usually partner with different carriers on specific routes, lanes, or areas. Hence, they have an extensive network of truckers, shipping companies, rail freight movers, and airline carriers that they work with.

Working with an expansive network enables them to connect shippers and consignees with flexible and low-cost carriers. This strategy enables them to increase their profits and find carriers willing to transport cargo for a competitive price.

They can also establish long-term relationships with shippers by offering lower rates while still maintaining healthy margins.

Exploring Vertical Expansion

Another way brokers maximize their profits is through vertical expansion, mainly through the procurement of a dedicated truck fleet. By doing so, they can integrate themselves within the supply chain of their customers.

With this strategy, they can meet their shipment schedules and reduce their reliance on external party timelines. Moreover, they no longer need to solely depend on intermediary fees as their income stream.

By offering a more complete service offering, they can attract more shippers and consignees. It’s also important to note that vertical expansion may also cause them to be in direct competition with some of their existing service providers.

Get Free Course Access

If you enjoyed the article, don’t miss out on our free supply chain courses that help you stay ahead in your industry.

Gerrit Poel

Co-Founder & Writer

at freightcourse

About the Author

Gerrit is a certified international supply chain management professional with 16 years of industry experience, having worked for one of the largest global freight forwarders.

As the co-founder of freightcourse, he’s committed to his passion for serving as a source of education and information on various supply chain topics.

Follow us